Crypto Bots for Traders

A crypto trader's guide to using bots.

What are Crypto Bots?

A "Bitcoin Bot" or "Crypto Bot" can mean a lot of things. Let's review the different kinds of bots within the cryptocurrency ecosystem, and how they are used. Please use extreme caution when dealing with any kind of crypto bot or related service. We will never ask you for any private information (such as a private key, account login credentials or API token) when setting up our monitoring service. The crypto space contains lots of scams, and you must be diligent when determining what is legit.Telegram Bots

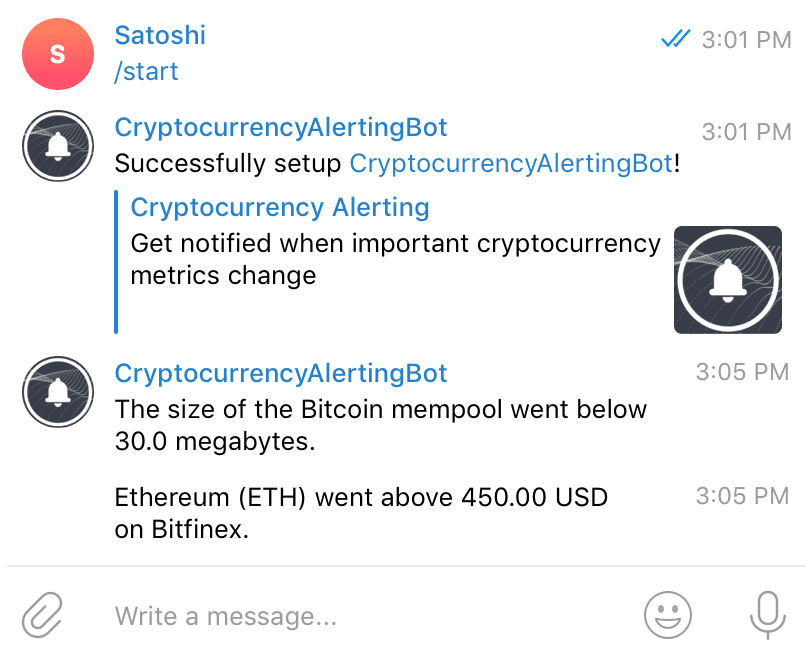

Telegram allows users to interact with bots in a chat-like interface. This is probably the most common kind of crypto bot that traders use, and it has a low barrier of entry.Telegram bots can work in both a private chat (with just yourself) or group chats with thousands of people. Bots can range from displaying simple information, like the current price of BTC -- to very involved signaling services that execute trades on your behalf (more on that below).

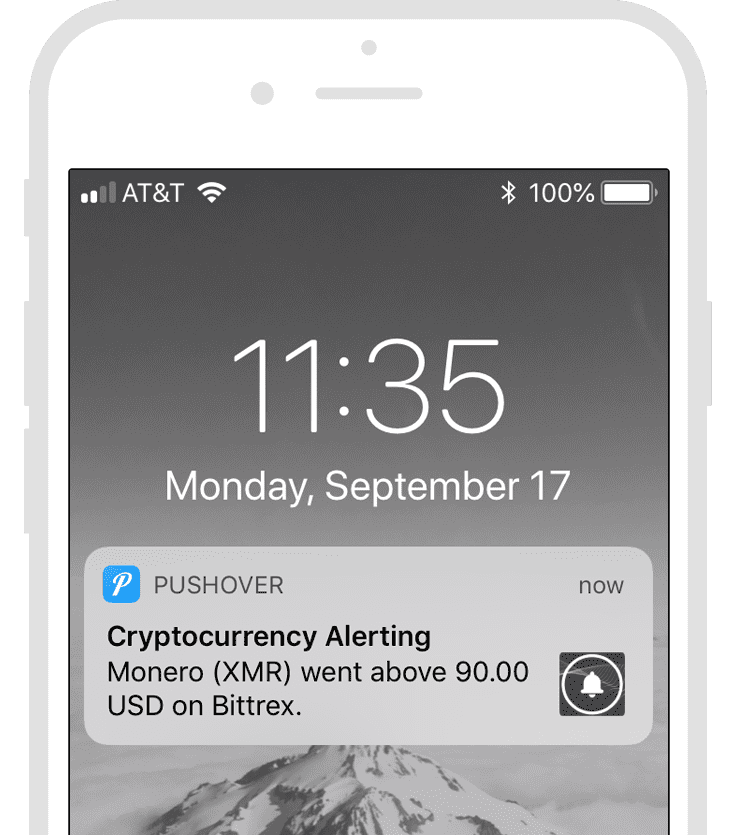

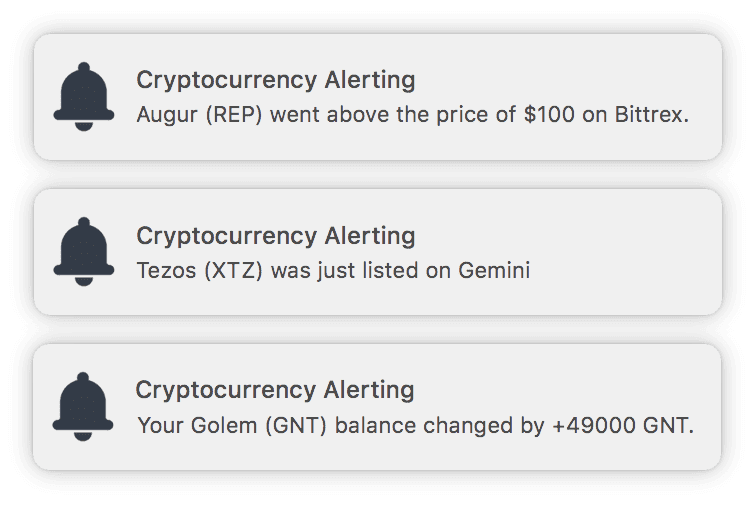

Our platform offers a telegram bot that can leverage our entire crypto & bitcoin monitoring platform. This includes customizable price alerts, volatility alerts, wallet monitoring, exchange listing notifications, bitcoin dominance alerts, and lots more.

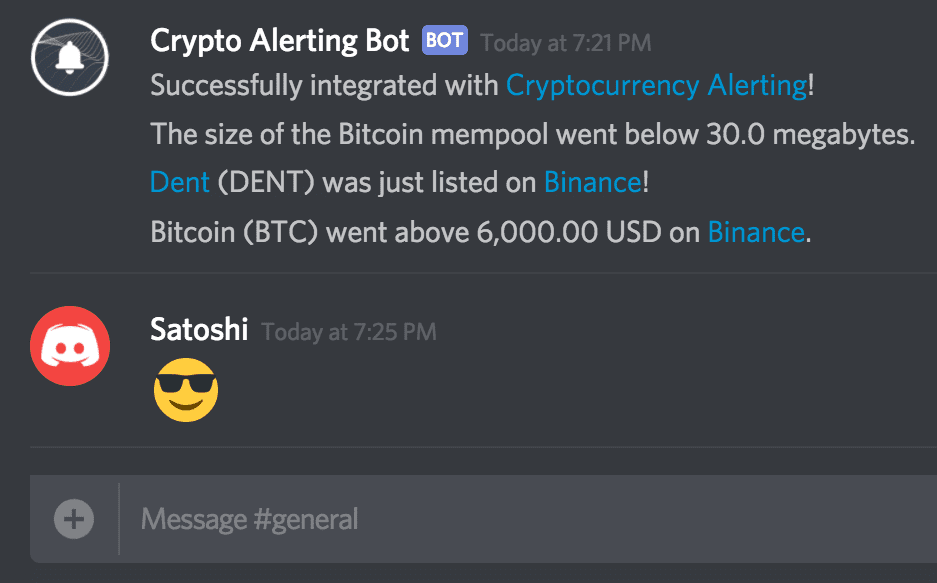

Discord Bots

Discord is another popular chat application, similar to Telegram. While it was originally targeted as an app for gamers, it has found a home among crypto enthusiasts as well. Just as many cryptocurrency projects have an official Telegram channel, many have chosen Discord for the same purpose.Discord Bots exist in various capacities just as they do for Telegram. Our Discord bot offers the same capabilities as our Telegram bot, including price alerts, transaction confirmation alerts, crypto marketcap alerts, BTC dominance tracking and more.

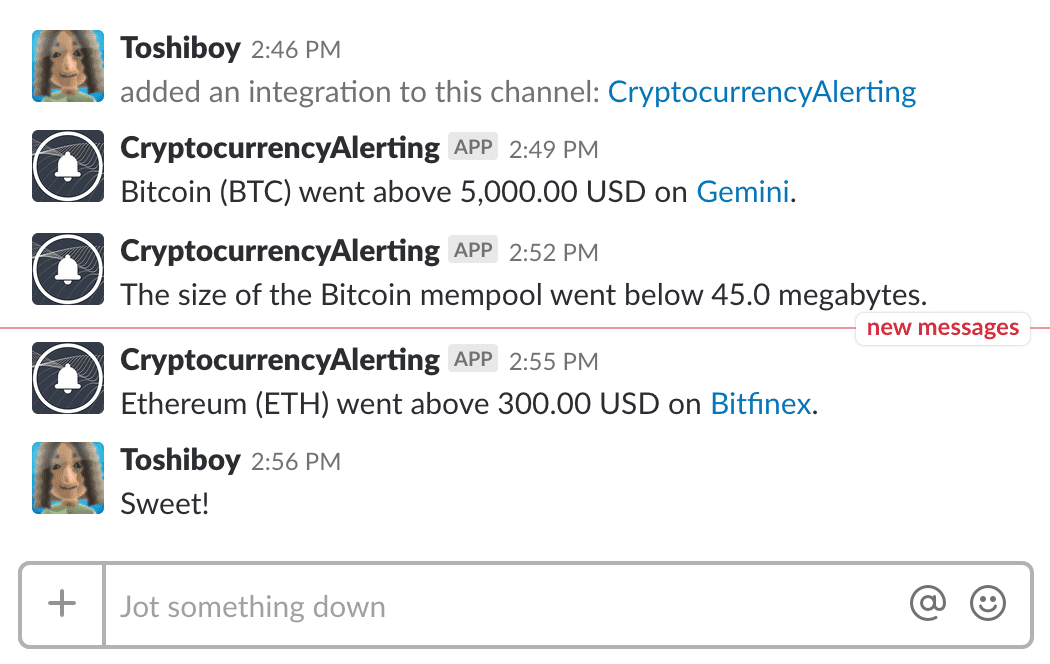

Slack Bots

Slack has a rich ecosystem of apps that are curated into an official Slack App Directory. While similar in functionality to Telegram and Discord, Slack is often where companies choose to have their internal discourse, rather than communities.We have our own listing in the Slack App Directory, capable of price alerts, transaction confirmation alerts, crypto marketcap alerts, BTC dominance tracking and more.

Crypto Trading Bots

Since all major exchanges have APIs (ways to programmatically interact with the exchange), those with programming knowledge can write software that automatically trades based on algorithms. Various libraries and open source tools exist to make this work a little easier. Catalyst, for example, is an algorithmic trading library for crypto assets written in Python. Links to more open source products are listed below. Remember, this is very risky endeavor. Trading with real money means that a single bug can completely wipe you out. Some services and exchanges offer paper trading, which allows you to test things out with fake money.Trading bots come in various flavors and varieties. They can have a simple strategy based on common technical analysis indicators, or use a proprietary combination of ideas and metrics to decide which trades to execute. Arbitrage trading bots capitalize on brief price differences across exchanges This requires trading accounts across multiple exchanges to pull off.

Trade copying or trade mirroring bots allow users to simply follow someone else's trading habits.

In the same vein, signal platforms such as 3Commas, Cryptohopper, HaasOnline and Zignaly have marketplaces where users can subscribe to signal providers, who directly send out trading signals (usually via Telegram). Both the platform and the signal providers often charge monthly fees.

Trading Terminals provide ways to interact with exchanges via the command line. This interface is essentially a scripting language, so lots of commands can be chained together to help automate trading strategies as well.

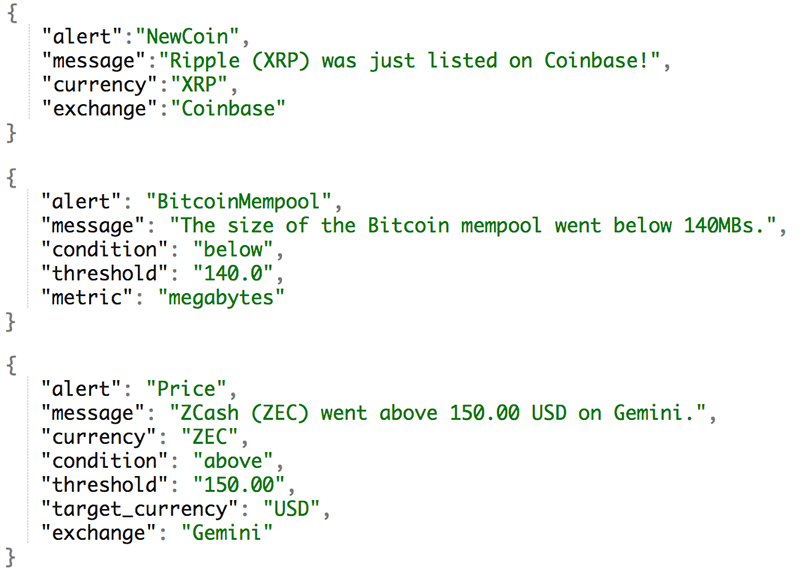

Anyone writing a trading bot can use our webhook notifications and REST API to take advantage of our entire crypto monitoring platform.

BitMEX Trading Bots

BitMEX Trading Bots

Among the most popular exchanges for automated trading is BitMEX. Since they are a derivative exchange, users can go long or short in their trades, and turn up leverage as high as 100x. Check out the BitMEX Automated Trading Engines page to view some automated trading software that is officially supported.Here are some of the most popular open source BitMEX trading bots:

Binance Bots

Binance Bots

Binance is the most popular exchange in the world, there are unsurprisingly many bots associated with the exchange and it's numerous derivative platforms.Here are some of the most popular open source Binance trading bots:

More Resources

- How to set up our Telegram Bot, Discord Bot and Slack Bot.

- Read about the signals and indicators used by crypto traders.

- See the stats and metrics researchers and analysts use to gain insight into the crypto space.

- Learn about crypto derivative exchanges.

- A popular third-party directory of crypto bots.