An Analysis of Crypto Stats

A look into common stats and metrics that crypto traders use.

Crypto vs Legacy Markets

While Bitcoin is barely a decade old, it has given rise to an entirely new class of financial assets. These assets operate in a global marketplace, and they do so 24/7. There are lots of differences between crypto assets and traditional (legacy) markets. Blockchains are transparent ledgers, which means that every wallet and transaction can be studied, analyzed and digested into a new field of metrics and statistics. Let's review some of the most useful stats that are unique to the crypto space.Average Fee Size

In order to send cryptocurrency to another wallet address, a fee must be paid to the network. The higher the fee, the faster the transaction will take place. You essentially get to cut the line if you decide to pay more. Since blockchains have a limited capacity, the line of pending transactions can start to build up when there is a large amount of activity. This causes people to pay more in order get their transaction to settle in a reasonable amount of time. Keeping track of the average fee size over time can be a very useful metric when monitoring the crypto space.Whale Alerts

A Whale is someone with a huge amount of crypto that can singlehandedly cause the price of an asset to move when they buy or sell. Since blockchains are public ledgers, it's easy to spot the largest wallets and the largest transactions for a given cryptocurrency. People often speculate on the meaning behind these large transactions.Number of wallets / growth of new wallets

The number of wallet addresses that hold a balance can help represent the adoptions of a given crypto asset, such as Bitcoin or an ERC-20 token. This isn't a perfect indicator, however, since anyone can generate a new wallet on the fly. Aggressive airdrops can also make it seem like a lot of people own an asset when they didn't even ask for it. In these cases, additional analysis can often be done to help refine the data further.Number of wallets with a minimum balance

Traders and blockchain analysts often look at the number of wallets that currently exist with a balance above a certain minimum threshold.Long term holder sentiment

It's easy to know how long a given wallet has existed, since you can just look at when the first transaction occurred within it. It's then possible to see if these older wallets are generally selling or accumulating bitcoin or any other asset. The older the wallet, the longer the owner of that wallet has been aware of this space, and it likely more knowledgeable and informed than a newer one.Difficulty & Hash rate

Difficulty is a measure of how difficult it is to mine BTC. Hash rate is the amount of processing power of the entire Bitcoin network (the sum of all the computers that are mining BTC). If a lot of new miners show up, you'll see a jump in hash rate.The difficulty gets periodically adjusted to account for changes in the hash rate. This attempts to ensure that Bitcoin blocks continue to be mined at a consistent rate of approximately 1 every 10 minutes.

ETH Locked

Ethereum allows funds to be locked up (frozen) according to rules in a smart contract. ETH can be locked up for a number of reasons, such as to provide collateral for a loan or to mint DAI. Funds that are locked up cannot be traded, so this effectively reduces the circulating supply of the asset. The rise of DeFi has accelerated this trend significantly, and it is often one way to measure the adoption of DeFi projects. There are now billions of USD worth of ETH locked up.Exchange Inflow / Outflow

Most major exchanges have wallet addresses that are publicly known. It's possible to track if traders and investors are generally putting more funds into exchanges or largely pulling them out. When fiat or stablecoins flow into exchanges, it's easy to assume that a lot of crypto-purchasing is about to occur. When a lot of crypto is entering an exchange, people often assume that a sell-off is imminent. When a lot of crypto is exiting an exchange, a whale may be going dormant.Tether Printing

While this may change one day, Tether remains to be the most widely used stablecoin (by far). When new Tether (USDT) is printed, this can signal the intent for a whale or institutional investor to buy lots of crypto in the near future.BTC Halving

Read our guide about the Bitcoin Halving here.BTC Mempool Size

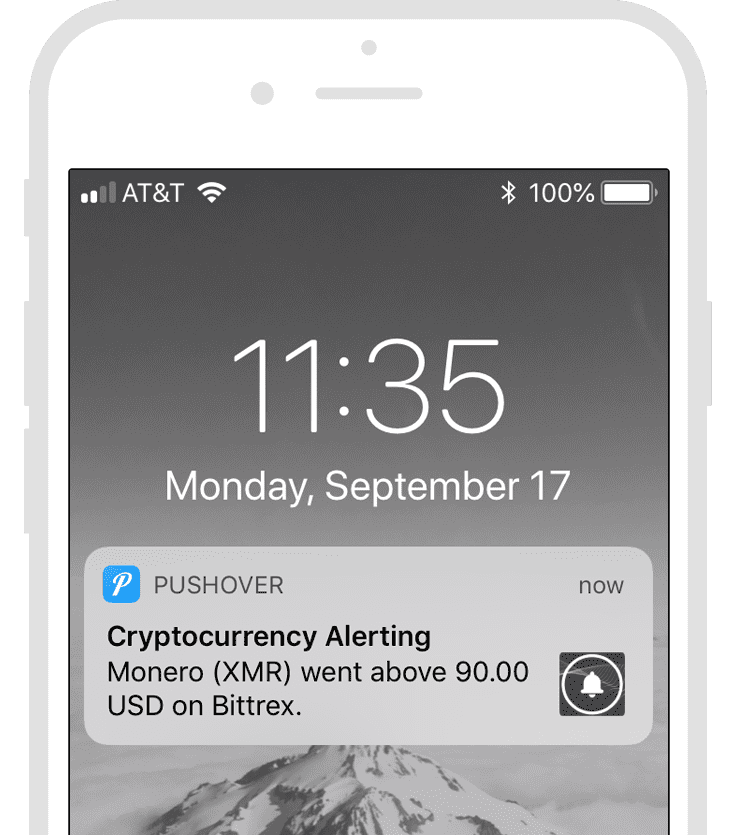

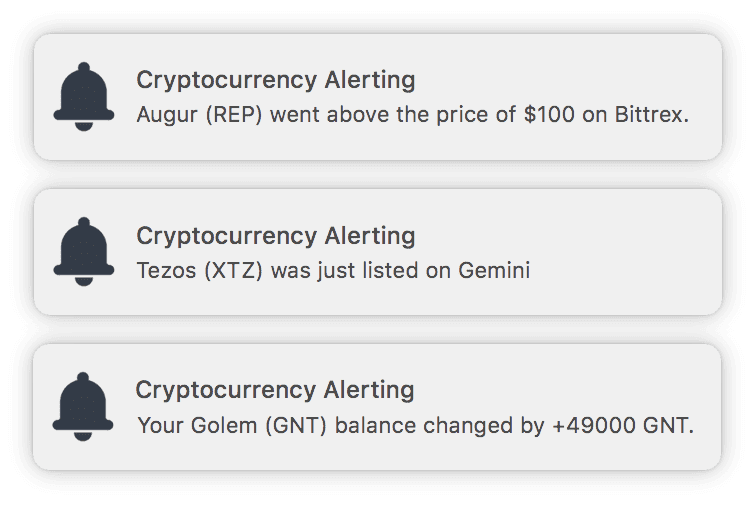

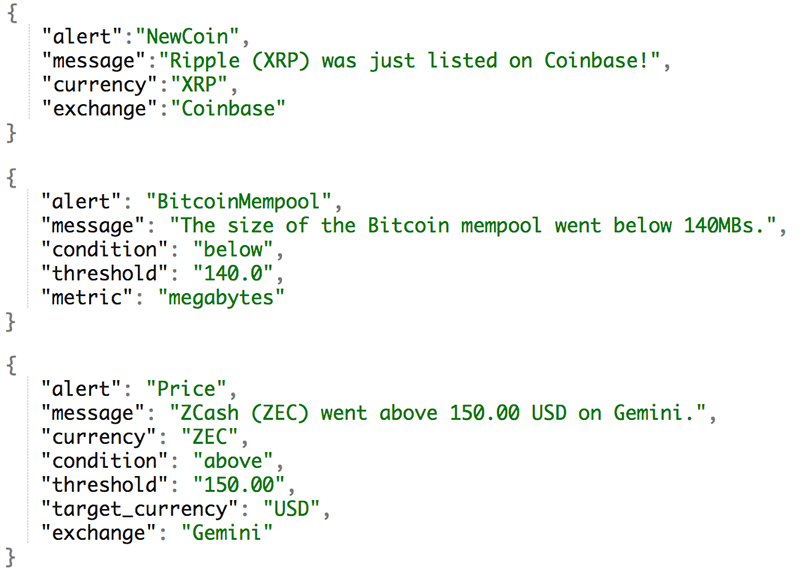

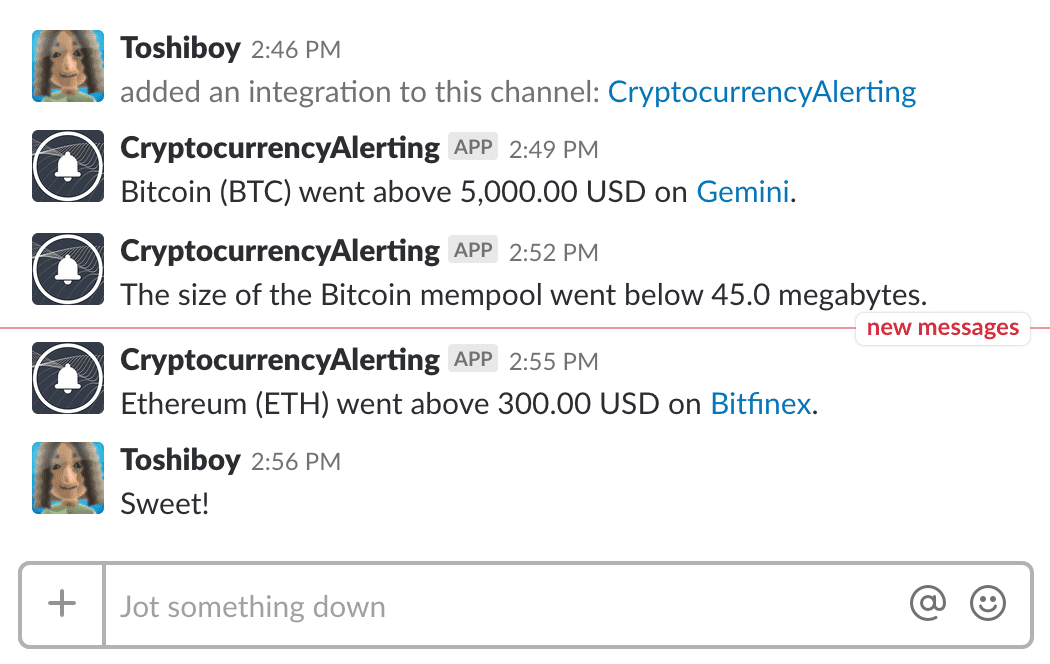

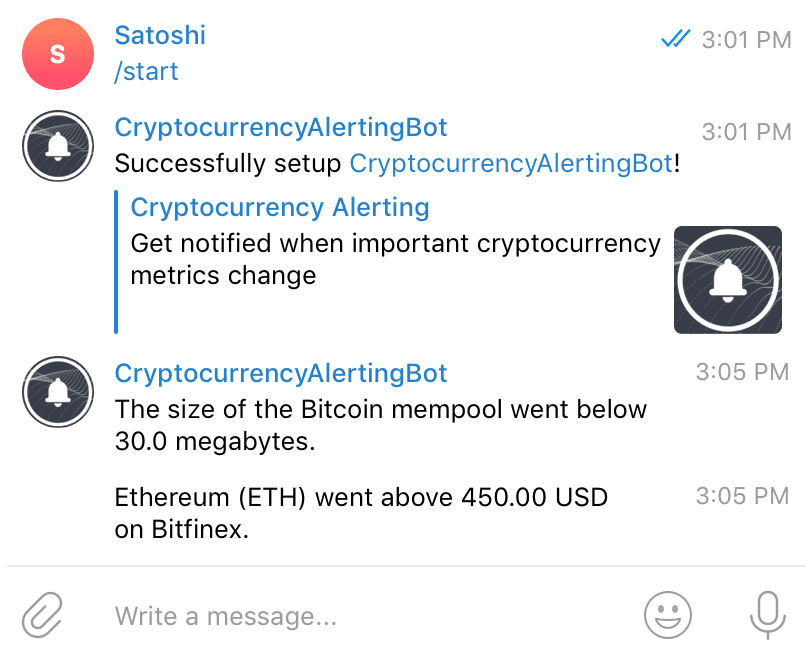

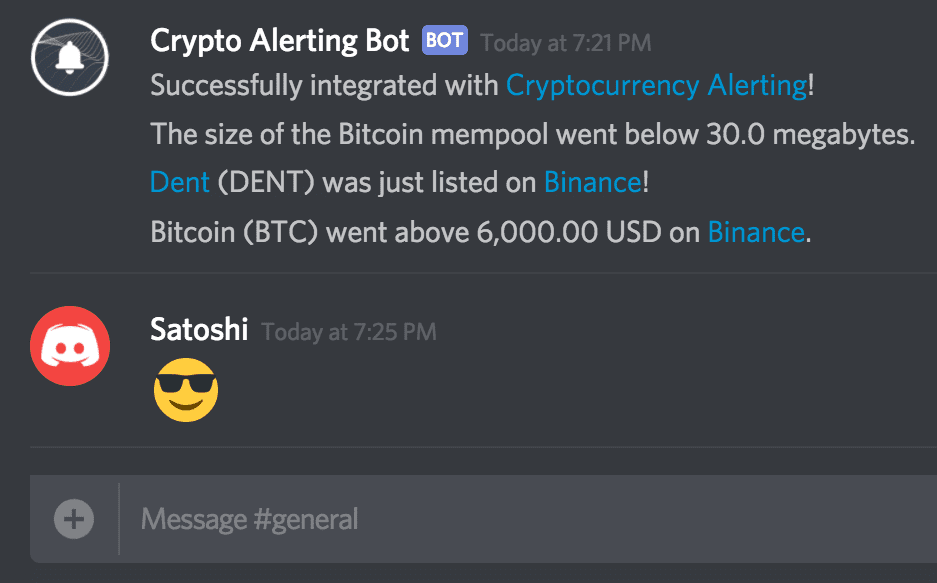

The Bitcoin Mempool is where pending transactions wait to be written to the blockchain. It's an easy way to see how much activity is going on at a given time. A large mempool size means that there is considerable traffic on the network, and that lots of transactions are waiting to be processed. Other cryptocurrencies have similar concepts under a different name. Our platform offers customizable mempool size alerts.Forks

When a blockchain changes, it either goes through a soft fork or a hard fork. When the change is optional and doesn't break old versions of the protocol, it is known as a soft fork. A hard fork is when the chain literally splits in two, and anyone who held funds previously now has two versions of their cryptocurrency. A hard fork is contentious if the community does not all agree on which version of the blockchain is now the superior one. The market will then decide how to value these two assets moving forward.Bitcoin Dominance

Dominance measures the percentage of the total crypto marketcap that a given coin represents. Bitcoin Dominance, for example, is a measure of BTC Marketcap divided by the total crypto marketcap. This is a useful metric to measure the relative strength of Bitcoin in relation to altcoins. We offer realtime bitcoin dominance alerts.More Resources

- Learn about commonly used signals and indicators that crypto traders use.

- Get Crypto MarketCap Alerts

- Get Crypto Breakout Alerts

- Get Exchange Listing Alerts