Crypto Buy Signals

Learn about commonly used signals and indicators for when to buy bitcoin and other crypto assets.

What are indicators?

Crypto indicators are metrics used to help predict short-term overbought or oversold conditions. It's not unusual to look at several indicators simultaneously when trying to form an opinion about an asset.An oscillator, for example, is a specific kind of indicator that varies over time between a min and max value. A few examples of these are explained below.

It's worth noting that most indicators will vary depending on the crypto trading pair being examined. That is, the chart of ETH/USD will produce different stats than ETH/BTC. ETH can look oversold on one chart, and not on the other.

What are signals?

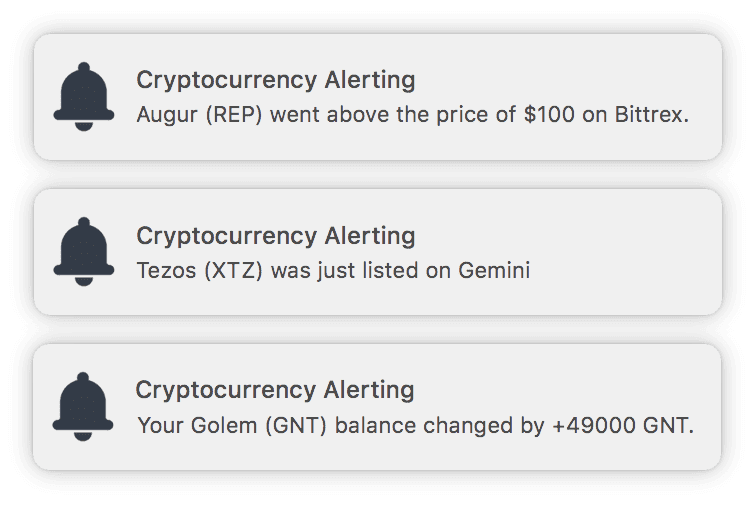

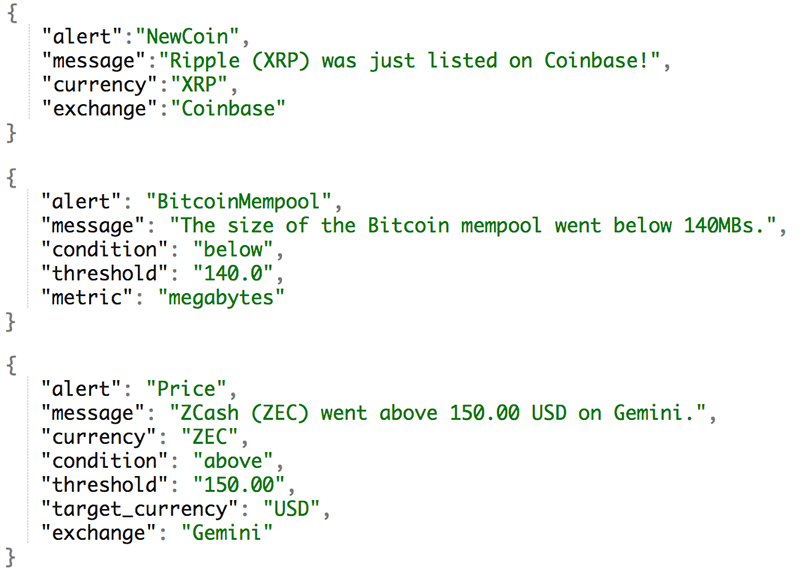

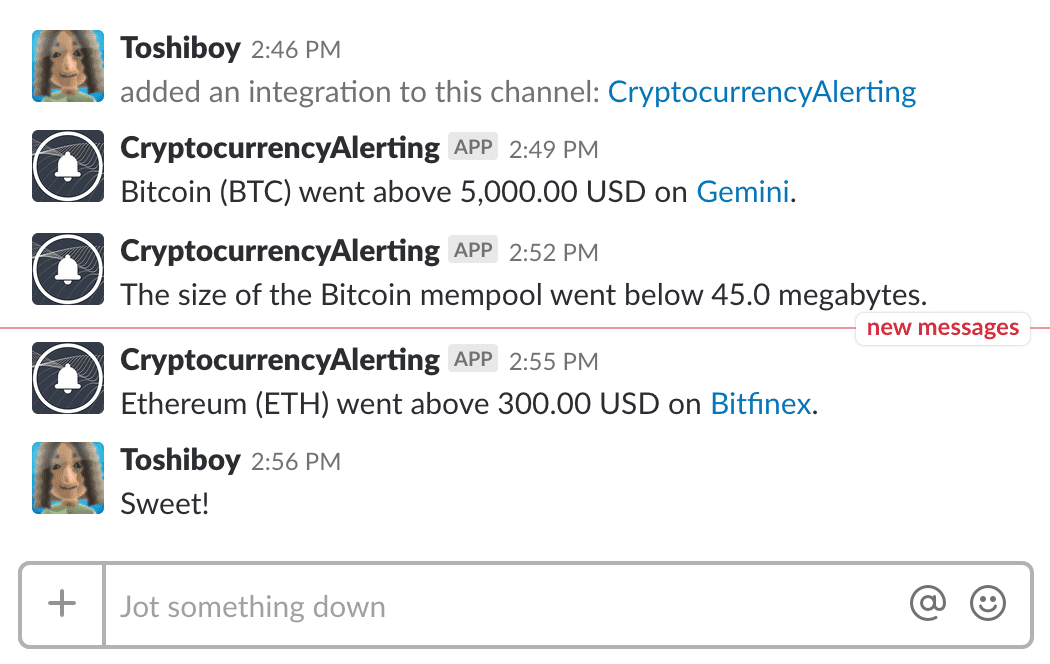

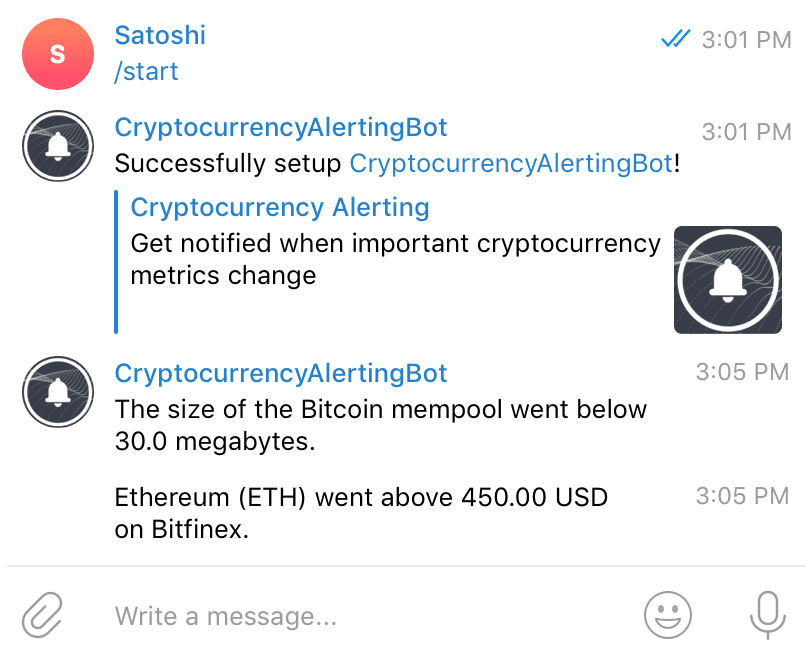

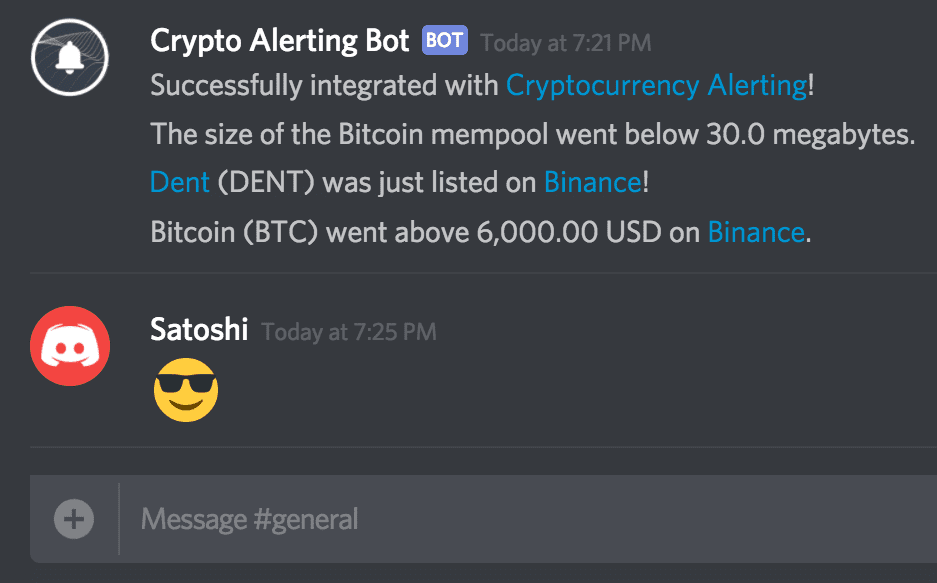

Crypto signals are direct recommendations (usually based on one or more indicators) to buy or sell a position. A buy signal means that a crypto asset looks oversold and ready for a short-term gain. A sell signal implies that a crypto asset looks overbought and is ready to decrease in price. Since derivative exchanges like BitMEX, OKEx or Binance Futures allow traders to enter short positions, a sell signal is actionable even if one does not already own the asset.Popular crypto indicators

RSI

Relative Strength Index (or RSI) is a momentum indicator that measures the speed and change of price movements. The value oscillates between 0 and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30.Moving Average

A Simple Moving Average (SMA) is calculated by adding recent prices and then dividing that by the number of time periods. A 50-SMA, for example, is the average of the last 50 price values for an asset. An Exponential Moving Average (EMA), on the other hand, places greater weight on the most recent data points.Golden Cross

A golden cross occurs when a short-term moving average crosses over a long-term moving average to the upside.Death Cross

A death cross is the opposite of a golden cross. It occurs when a short-term moving average crosses below a long-term one. Some common moving averages include the 50-period and 200-period moving averages.Divergence

When the price of an asset is moving in the opposite direction of a technical indicator, this is known as a divergence. A divergence warns that the current price trend may be weakening. For example, if an asset's price has recently been making higher highs, but the RSI has been making lower highs, it could signal that it might be a good time to start selling.MACD

MACD is an acronym standing for Moving Average Convergence/Divergence. It is a trend-following momentum indicator that shows the relationship between two moving averages. It's usually calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA.Price Breakouts

Volatility is another important statistic when analyzing crypto assets. Bitcoin and altcoins in particular are an incredibly volatile class of assets. Price breakouts occur when lines of support and resistance are broken, typically on high volume (more on this below).Price breakouts are usually the culmination of a chart pattern confirming a trend. To learn more about reading crypto chart patterns, read our guide. Our alerting platform also offers crypto price breakout alerts across entire markets spanning dozens of exchanges.

Volume Breakouts

Trading volume is usually represented as a bar chart below the price chart of an asset. Volume breakouts add conviction to a large price move, and show that there's significant support behind the recent swing. A high volume move has a lower chance of being a false-breakout.Monitoring volume is a large part of technical analysis and is used in conjunction with other technical indicators when looking at price charts.

Wrapping Up

These indicators are some of the most common ways that crypto traders generate signals to buy or sell. However, none of these stats are unique to cryptocurrencies. To learn about stats and metrics unique to blockchain-based assets, continue reading here.More Resources

- A guide to understanding crypto stats and metrics.

- How to get crypto price breakout alerts.

- Learn about bitcoin derivative markets.