Bitcoin & Crypto Derivatives

Learn about crypto derivative exchanges and how traders use them.

What are derivatives?

A derivative is a standardized contract whose value is based on an underlying crypto asset, such a Bitcoin or Ethereum. Exchanges like BitMEX, Kucoin, Binance Futures, Huobi, and OKX have all introduced many kinds of derivative products into the crypto space. This article will give an overview of these financial tools.What are the advantages of trading derivatives?

Most notably, leverage allows traders to amplify their risk/reward ratio. BitMEX famously offers up to 100x leverage, and some exchanges are taking that even higher.Trading derivatives allows an investor to have no direct ownership of an asset. Since a derivative represents a contract that has value relative to another asset, this ends up being a way to have price exposure to an asset while not having direct custody it. This may have legal and regulatory advantages for some.

Going short means that traders can profit from downward price movement. Being able to trade off both positive and negative price swings allows for twice as many trading opportunities.

Futures

A futures contract is a standardized legal contract to buy or sell something at a predetermined price at a specified time in the future. These contracts are rarely executed directly. Rather, they are simply bought and sold as their value fluctuates.Options

An options contract gives the buyer the right (but not the obligation), to buy or sell an underlying asset such as Bitcoin, at a specific "strike" price. Options typically expire at a pre-determined date in the future. The value of an option is determined by its strike price relative to the current price of the underlying asset + a premium for how much time remains before the option expires.Buying a "put" gives the holder the right to sell an asset at a specific price and date in the future. Buying a put means the owner is bearish. Buying a "call" gives the holder the right to buy an asset at a specific price and date in the future. A call is bullish.

Leveraged Tokens

Certain exchanges such as Binance and Kucoin offer leveraged tokens. These simply represent leveraged (multiplied) exposure to another asset, and have names such as ETHBEAR, BTCBULL, ETHUP, and BTCDOWN. The amount of leverage applied to these tokens is typically 2-3x, but that may vary over time.Perpetual Swap

Perpetual Swaps are essentially a futures contract with no expiry date.Spot Markets

When talking about futures and perpetual swaps, a "spot" market is the name given to a standard crypto asset exchange. Spot markets trade crypto assets for immediate delivery. Typically you can't withdraw a derivative off of an exchange, whereas crypto assets themselves can be withdrawn into personal custody.Prediction Markets

Prediction markets allow traders to bet on real-world event outcomes that haven't happened yet. Common examples are presidential elections, sports betting, or even the weather at a pre-determined date in the future. Projects like Augur have taken this notion into the crypto space.More Resources

- Learn more about BitMEX terminology.

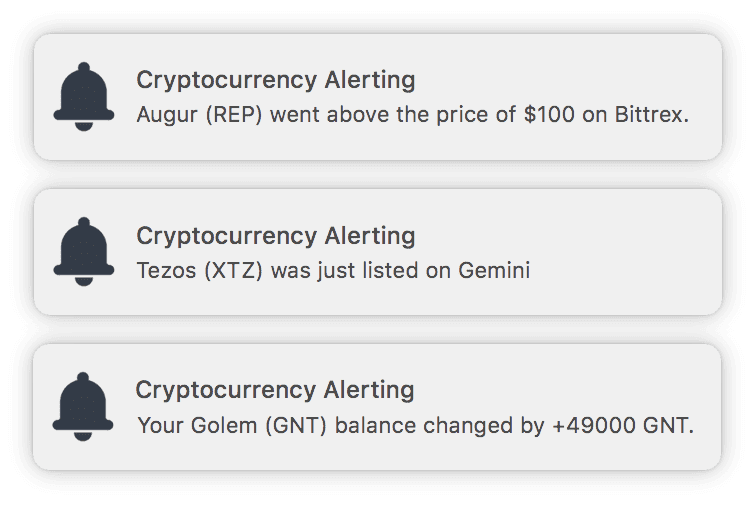

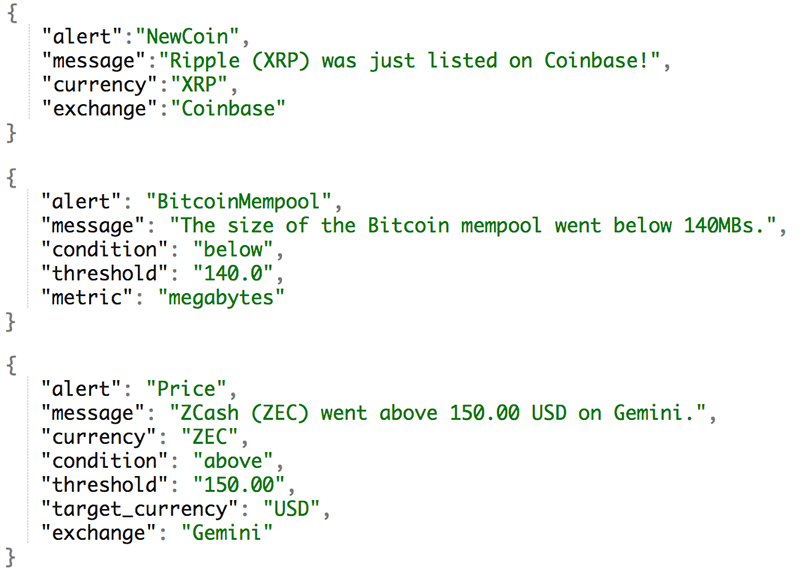

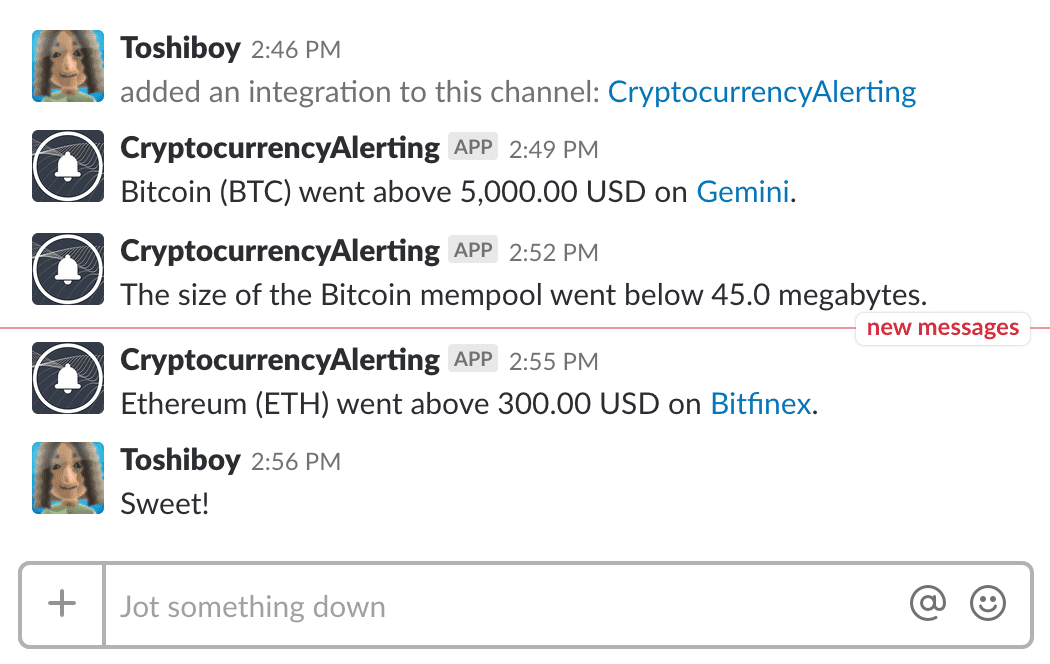

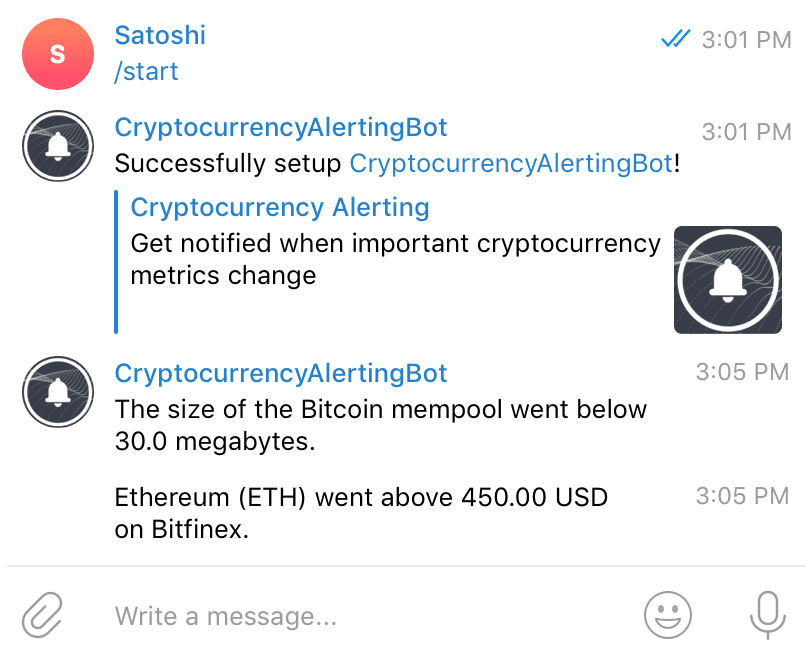

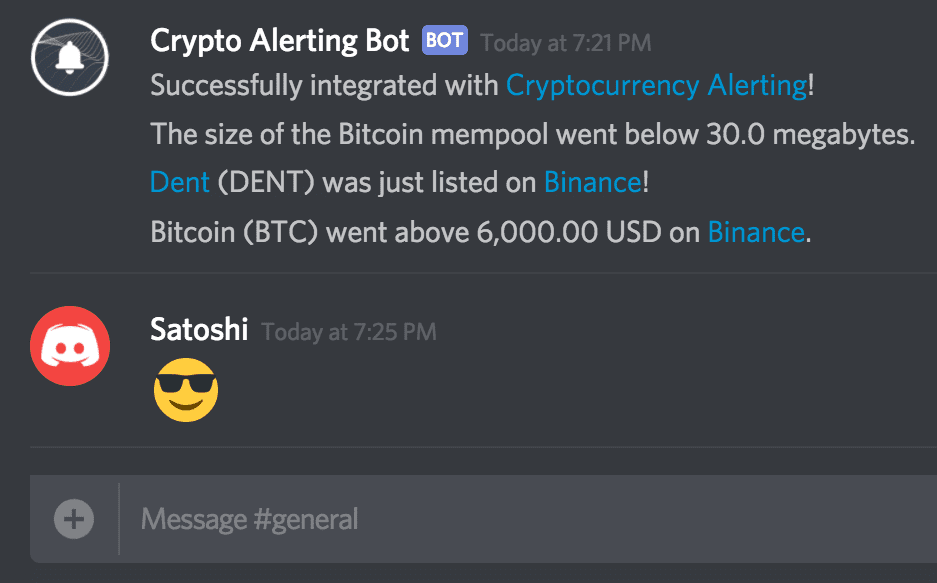

- Get customizable price alerts across dozens of exchanges.

- Create crypto volatility alerts across thousands of digital assets.