BitMEX Terminology

BitMEX Terminology

Learn about crypto derivative concepts like open interest, shorts vs longs, leverage, liquidations and more.

What is BitMEX?

BitMEX is a cryptocurrency exchange and derivative trading platform. Founded in 2014, it quickly became the de-facto way for traders to place up to 100x leveraged bets on bitcoin's price movement. It currently supports other large-cap altcoins, such as Ethereum, Cardano, Litecoin, Tron, EOS and Ripple. While several other exchanges have began to offer competing products (Binance Futures, Kucoin, OKX and Huobi to name a few), BitMEX still has daily trading volume that often exceeds $1 billion USD. Let's review some of the unique concepts that exchanges like BitMEX bring to the table.BitMEX Open Interest

Open interest is the amount of open positions currently held on the exchange. Each trading pair has a different amount of open interest. This value can often correspond to an increase in volatility of Bitcoin or the entire crypto space, since it represents a number of highly leverages bets. A Bitcoin open interest chart can help view this relationship over time.BTC Longs vs Shorts

In margin trading, there are two types of positions: Long & Short. The relationship of Bitcoin shorts vs longs shows the total amount of long positions vs the short positions currently open. Seeing this can be useful when determining if one side is more leveraged than the other. This could help predict the next long / short squeeze in the market.> A "squeeze" happens when traders notice that a lot of people have leveraged bets in one specific direction. This means that if the price moves against them, they will get liquidated. When a trade is liquidated, it must be automatically sold on the market to cover losses. This creates a feedback loop, causing even more price movement and even more liquidations.

Margin & Leverage

Derivative exchanges allow traders to use borrowed funds to amplify their risk/reward. The amount of collateral you have relative to your total buying power is determined by your leverage. While traditionally, it is possible to go into debt trading on margin, most crypto exchanges like BitMEX do not operate this way. Instead, your trades will become liquidated if they lose too much value to prevent a balance below zero.BitMEX provides leverage up to 100x. Binance now offers 125x. With leverage turned up this high, it is very easy to become liquidated and forfeit your position!

Liquidations

A liquidation event occurs when your position is forcibly closed during margin trading. Colloquially, this is often known as getting rekt.When opening a leveraged trading position, its liquidation price is automatically determined. If the price moves past that, you get liquidated. The higher the leverage, the quicker you'll be liquidated if the trade goes against you. The number of liquidations at any given time can show if a short/long squeeze was triggered.

Insurance Fund

Insurance funds help protect bankrupt traders from unfavorable losses and guarantees that other traders will get their profits. The fund is added to with liquidated positions, as it grows from liquidations that were able to be executed in the market at a price better than the bankruptcy price.BitMEX Trade Bot

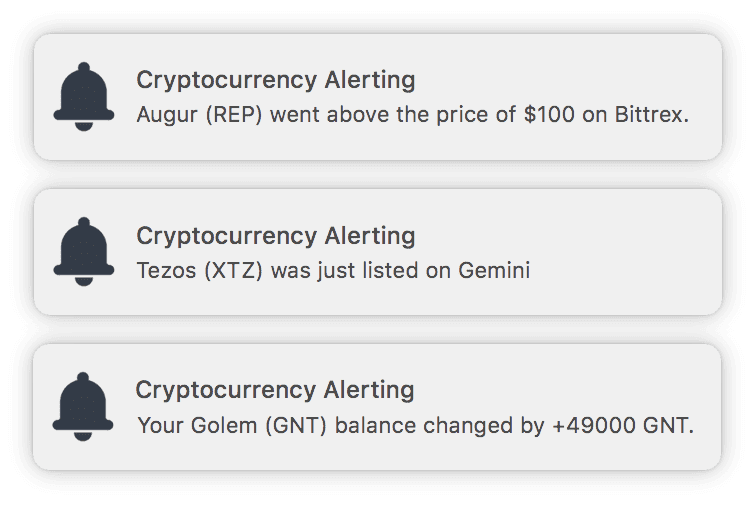

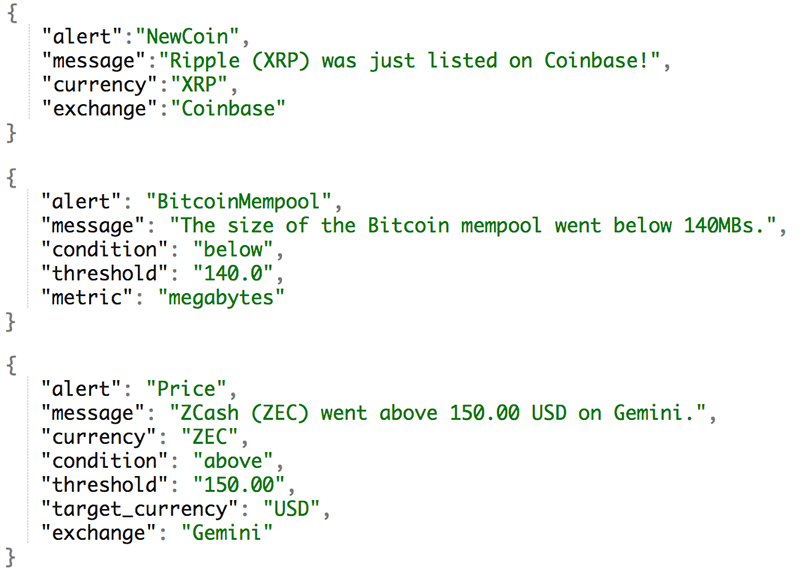

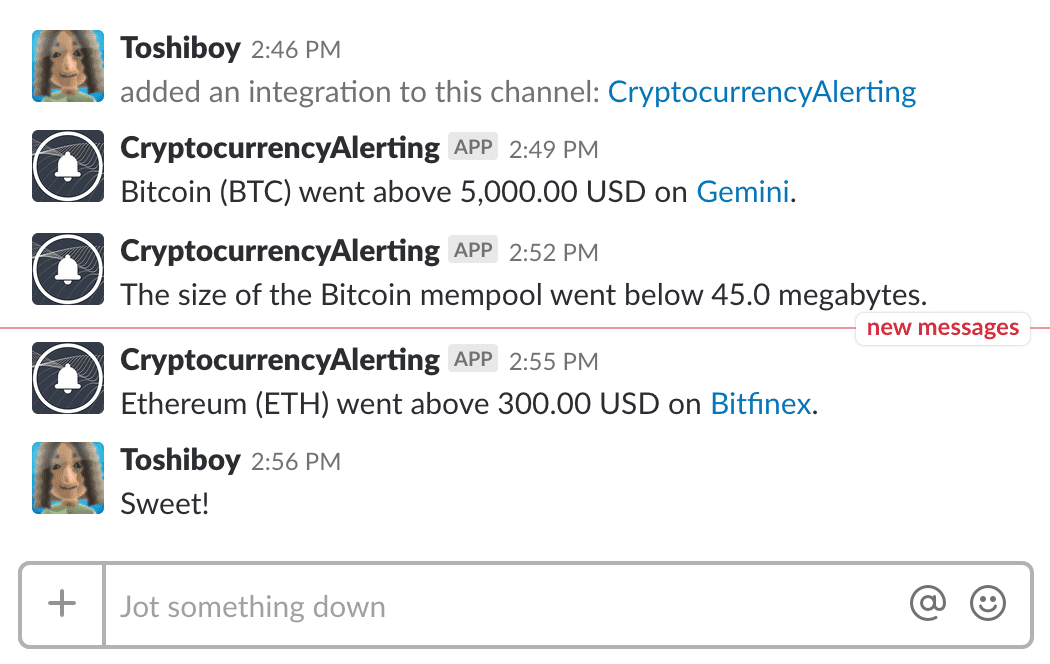

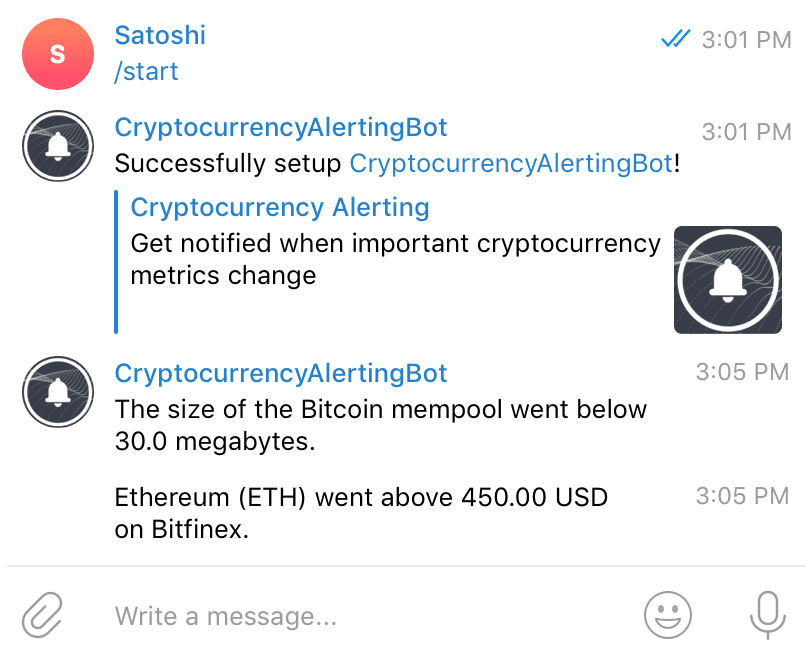

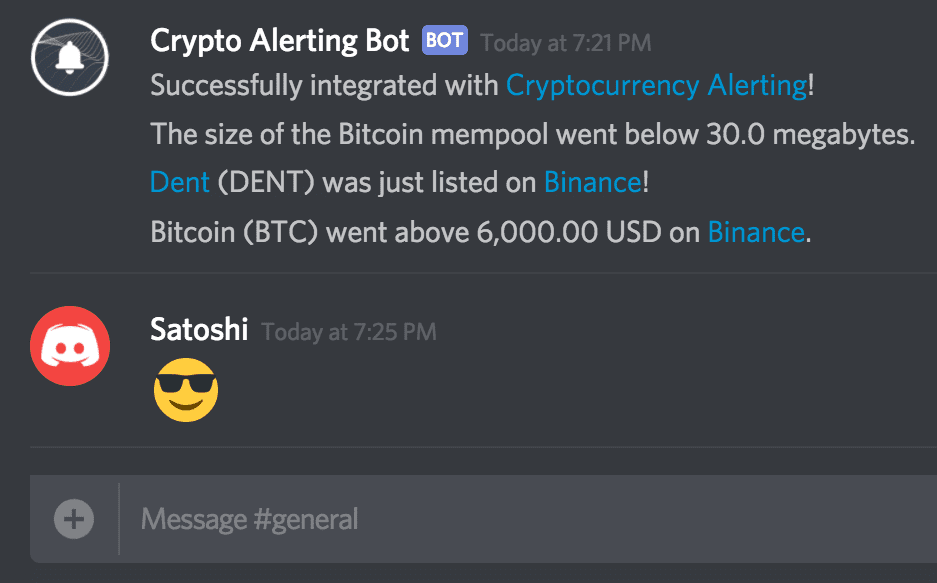

BitMEX offers an API that allows people to write software that can execute trades algorithmically. Traders can write this software themselves, or use pre-existing bots that have been open-sourced on GitHub. Telegram bots also exist, which take many shapes and forms. Some allow users to execute trades directly through commands in Telegram itself. Others display useful stats, metrics and prices about an asset.Our platform offers a BitMEX telegram bot (as well as a Slack and Discord bot) that can track real-time price movements across Bitcoin and every other listed asset.

More Resources

- To learn more about crypto derivative markets in general, read our Crypto Derivatives Guide.

- What is BitMEX?

- BitMEX knowledge base