Crypto Glossary

Beginner-friendly explanations for common terms used within the crypto ecosystem. This includes the blockchain, cryptography, investing and cultural memes.

51% Attack

A specific method of attacking a blockchain, where a single group of miners control more than 50% of the network. This allows a centralized party to control the "truth", effectively destroying its integrity.Accredited Investor

Someone who has a net worth greater than $1,000,000 and meets certain additional income requirements. Qualifying individuals may file with the SEC to obtain this status. In the United States, only accredited investors may invest in hedge funds, venture capital funds, and other "advanced" forms of investing.Airdrop

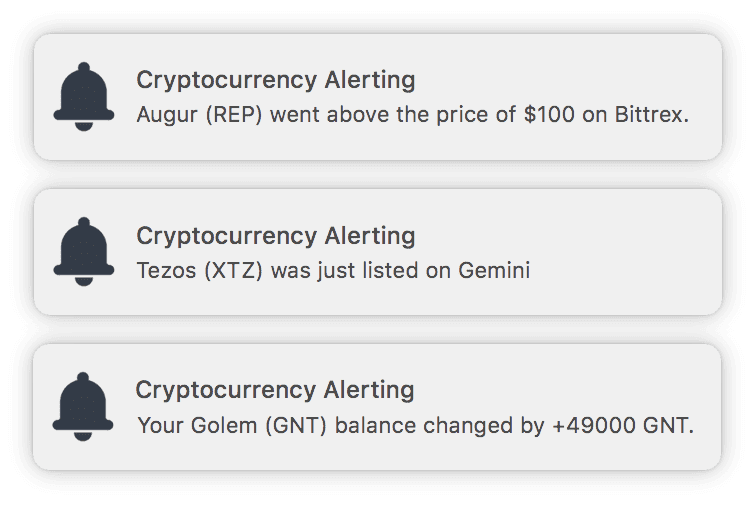

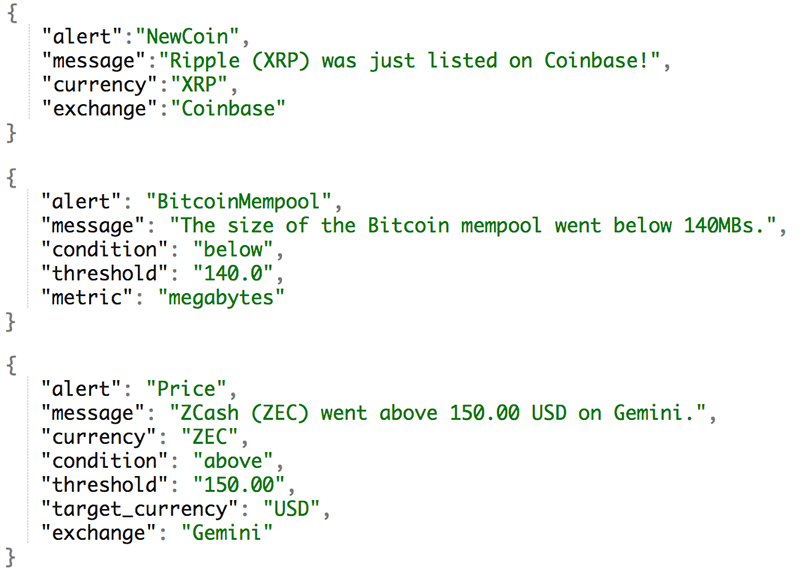

An event in which a blockchain project gives away tokens or coins for free. A simple condition may need to be met, such as having a certain existing balance in your wallet or registering before a deadline. Teams may elect to do this to raise awareness of a project, or ensure that a cryptocurrency is not consolidated among too few people.Our platform provides free airdrop monitoring of any Ethereum wallet.

Air Gapped Device

A device that has never been (and will never be) connected to an unsecure network, such as the internet. This is a strategy to store cryptocurrency as safely as possible.ASIC (Application Specific Integrated Circuit)

A computer that is specifically designed to mine cryptocurrency. The rise of ASICs has lead to more miner centralization since they make it harder to be profitable mining on a regular CPU or GPU.Atomic Swap

The exchange of one cryptocurrency for another without the need for a trusted third party, such as an exchange. Atomic Swaps happens directly on the blockchain.Algorithmic Trading (Algo Trading)

A strategy of using software to strategically buy and sell assets. This software is commonly referred to as a "trading bot" or an "algorithmic trading bot".Alpha

Alpha refers to any new information or insight that will allow people to have an advantage when investing.Altcoin

Shorthand for any cryptocurrency that isn't Bitcoin. For an overview of many different altcoins, view our Altcoin Explainer.AML (Anti Money Laundering)

A set of regulations designed to prevent the practice of illegally generating income.Ape

To "ape in" to an asset or a trade is to buy a position in it. This sometimes means the decision was made recklessly, or a large amount was invested, but the usage varies.Arbitrage

A price difference between the same asset across different markets. When this occurs, traders can buy on the exchange with the lower price and sell on the higher (turning a profit). This often happens due to low liquidity in an inefficient market. Over time, as arbitrage traders capitalize on the opportunity, the price gap will becomes smaller and eventually converge back to an unprofitable level.Our platform can help detect arbitrage opportunities by using our "Any Exchange" price alert or percentage price alert.

Backtest

Using historical data to test a predictive model or trading strategy in order to determine its effectiveness.Baking

Baking is the process that Tezos uses to append new blocks of transactions to its blockchain. It is a kind of delegated proof of stake. Bakers receive rewards for each block baked, similar to how Bitcoin miners receive rewards for discovering new blocks. A baker is more likely to bake a block if they have a larger number of rolls (groups of 10,000 XTZ). Accounts must be registered as a delegate in order to partake in the baking process, and can bake on behalf of other accounts who do not meet the 10,000 XTZ requirement.Bear Trap

A brief market recovery that gives the allusion of an upcoming bull market, but leads to further downward trends.Binance

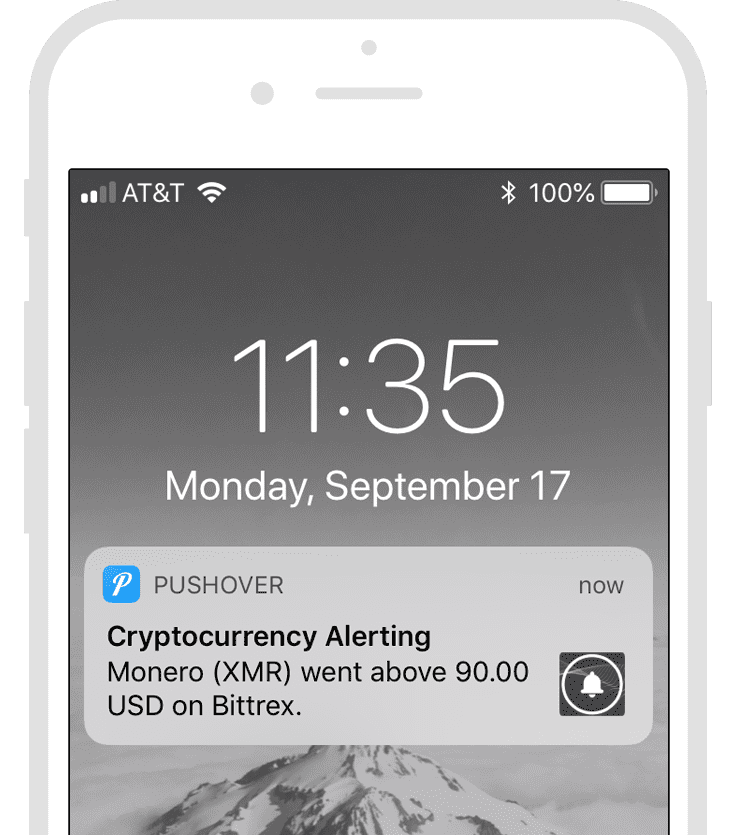

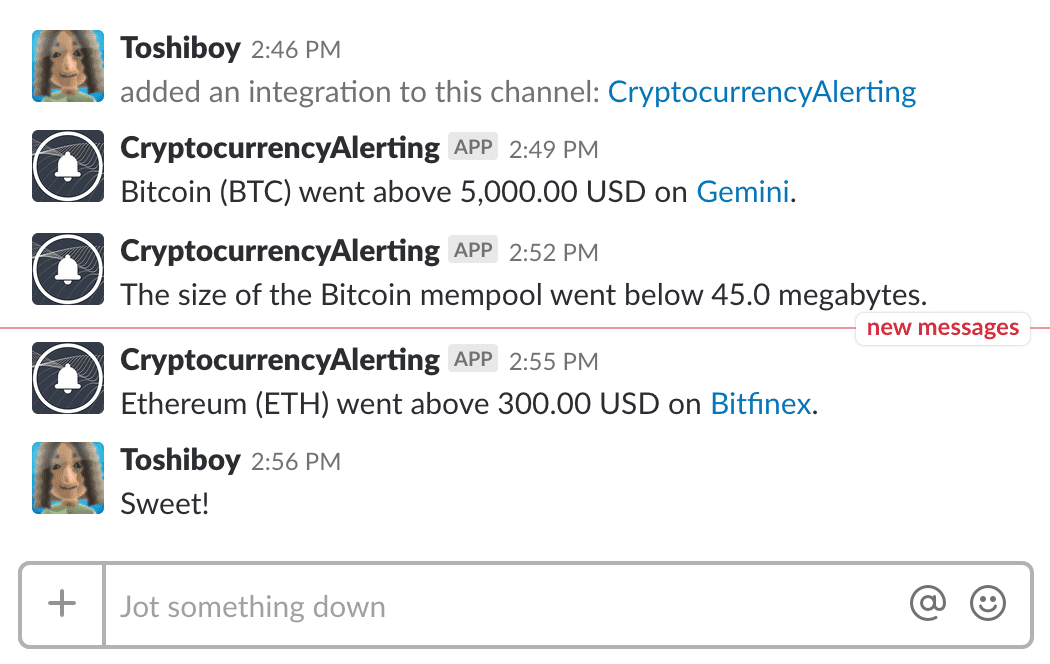

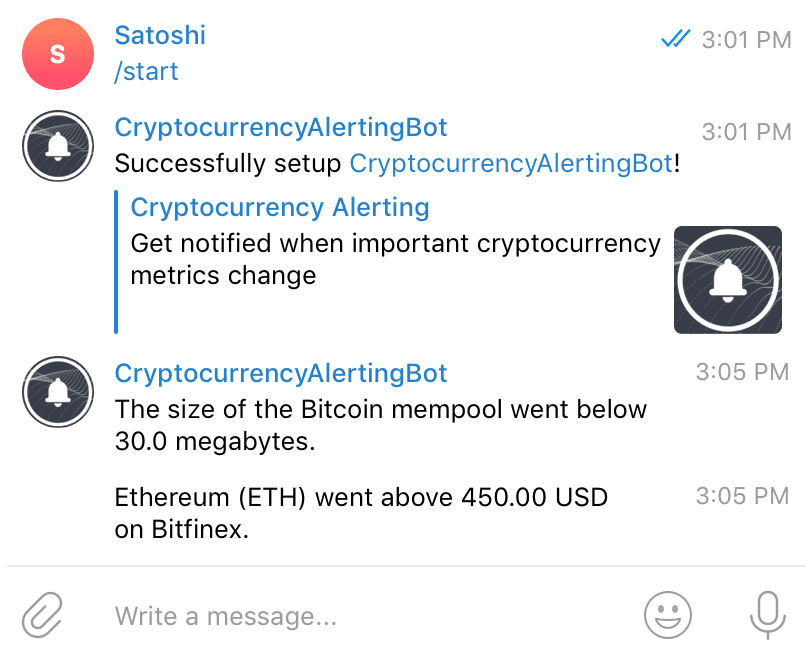

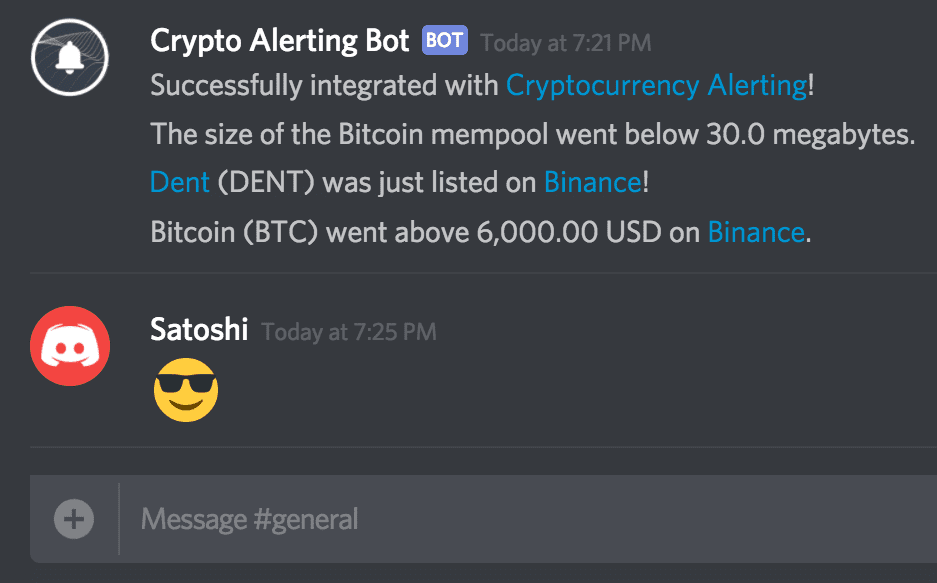

Binance is a cryptocurrency exchange founded in 2017 by Changpeng "CZ" Zhao. Despite being a relatively new exchange, it has quickly become the worlds largest (when measured by trading volume). It has over 200 listed cryptocurrencies available for trading.Our platform offers free Binance price alerts in addition to Binance exchange listing alerts.

Bid Ask Spread

The difference between the price that a buyer will pay for an asset and a seller will sell that asset. A highly liquid market will have a very small spread.BIP (Bitcoin Improvement Proposal)

A design document for introducing features or information to the Bitcoin protocol.Bitcoin

The first successful and widely used implementation of a blockchain, originally proposed by Satoshi Nakamoto. It's a peer-to-peer payment system and store of value. Bitcoin can refer to both the tradable asset as well as the underlying protocol and technology.Our platform supports free BTC price alerts, percentage price alerts, BTC wallet monitoring and mempool size alerts.

Bitcoin Maximalist

Someone who believes that Bitcoin is the only cryptocurrency that holds any real value or potential.Bitcoin Pizza Transaction

This refers to the first known purchase of a physical good with Bitcoin. On May 22nd, 2010 Laszlo Hanyec spent 10,000 BTC to purchase "a couple of pizzas".BitMEX

BitMEX is a cryptocurrency exchange and derivative trading platform founded in 2014 by Arthur Hayes. It is notable for offering up to 100x leverage on Bitcoin perpetual contracts, and up to 50x leverage on other large altcoin contracts like Ethereum.Our platform offers free BitMEX price alerts and percentage-based price alerts.

Bittrex

Bittrex is a cryptocurrency exchange founded in 2013, headquartered in Seattle, WA. It has a strong emphasis on security and has listed over one hundred cryptocurrencies.Our platform offers free Bittrex price alerts in addition to Bittrex exchange listing alerts.

Bollinger Band

A technical analysis indicator developed by John Bollinger which helps measure the volatility of a given market.Botnet

A collection of computers infected with malicious software and controlled remotely without the owners' knowledge.Bubble

A period of unsustainable growth in a market due to irrational exuberance, which eventually "pops" causing the market to crash.Bug Bounty

A reward offered to those who help find and fix vulnerabilities in computer software. This often applies specifically to security-related bugs.Buy The Dip (BTFD)

A common expression and piece of advice. It is the suggestion that someone should buy an asset whenever it drops in price, since its inevitably going to go back up in price.Black Swan Event

A catastrophic event that is very unlikely to occur (but given enough time, will almost certainly occur).Block Lattice

A specific type of DAG (Directed Acyclic Graph) first introduced by the Nano cryptocurrency. Each account has one blockchain which is controlled by the account's private key, and each blockchain is replicated to all peers in the network. This arrangement is called a block lattice.Blockchain

A decentralized database, often referred to as a public ledger. It's a chain of blocks, each of which record transaction data. New blocks are discovered by miners at a relatively fixed speed.Block Reward

The amount of a given cryptocurrency that is rewarded to miners when the next block has been mined.Brain Wallet

The act of storing cryptocurrency by simply memorizing your recovery phrase. If not written down anywhere, the key to these funds is only stored in your brain. See: WalletBreakout

When the price of an asset exits a level of support or resistance, usually followed with increased volume. Our platform can help detect price breakouts by using our free percentage price alerts tool.Burned Coin

Verifiably destroying a coin or token. This may be done for several reasons, such as rewarding existing stakeholders (reducing the supply tends to make the price go up), destroying unsold tokens from an ICO, or replacing them on an upgraded chain.Byzantine Fault Tolerance

The characteristic of a system that is able to tolerate the issues brought up by the Byzantine Generals’ Problem.Byzantine Generals’ Problem

A thought experiment that is intended to illustrate the difficulty of reaching consensus in a distributed system. In the problem, a group of generals who each command a portion of the army, surround a city. These generals must develop a plan to either attack or to retreat. Every general must reach a collective decision (if a unified decision is not reached, and some generals decide to attack, while others retreat, then the uncoordinated attack or retreat, the army will fail). Generals must coordinate via messengers (whom may lie) and generals themselves may be traitorous.Candlestick Chart

A common way to graph the price of a financial asset over time. It differs from a basic line chart in that it contains more information. Each period, or "candle", contains the open, high, low, and closing price. A green candle typically means the price has gone up, and a red one means down.Capitulation

A large, final wave of panic selling where a market experiences a "bottom" for a given cycle.Chart Patterns

Chart patterns are distinctive, recurring movements in the price of a financial asset. Technical analysis frequently involves the study of chart patterns (along with several other indicators) to help predict and model future price movements.Circulating Supply

The number of coins or tokens that are circulating in the market and in the hands of the general public.Coinbase Pro

Coinbase Pro (originally named GDAX) is professional-grade cryptocurrency exchange.Our platform offers free Coinbase Pro price alerts in addition to Coinbase Pro exchange listing alerts.

Coinbase Prime

Coinbase Prime is a cryptocurrency exchange intended specifically for institutional investors, with support for Over The Counter (OTC) trading.Our platform offers free Coinbase price alerts in addition to Coinbase exchange listing alerts.

Confirmation

A transaction is considered to be confirmed once it has been written to the blockchain. If a transaction has multiple confirmations, it means that additional blocks have been mined after the block that contains the transaction in question. The higher the confirmation number, the more certainty that a coin has not been double spent.Our Wallet Watch service offers notifications when transactions have been confirmed on your wallet.

Consensus Mechanism

A consensus mechanism is the method that a blockchain uses to decide on the individual contributions of all its participants. Common examples are Proof of Work and Proof of Stake.Consolidation

A price consolidation occurs when the price of an asset remains within a tight range for a period of time. This is usually considered to be a "pause" between the next larger price move.Correction

A correction in a market is a drop in price after a significant gain, suggesting that the market is "correcting" back toward the mean.Cost Basis

The value of an asset when you purchased it, for tax purposes. Used to determine capital gain (difference between cost basis and the value it was sold at).CryptoKitties

A blockchain-based virtual game that allows players to purchase, collect, breed and sell various types of virtual cats. It famously clogged the Ethereum network at the height of its popularity. A single a CryptoKitty has been sold for over $100,000.Cryptocurrency

A digital currency in which encryption techniques remove the need for a trusted third party (such as a bank).CryptoPunk

The most expensive and prestigious NFT collection, created by Larva Labs. There are 10,000 in total, and many have been sold for millions of dollars a piece. Even Visa (the payment gateway) owns one.Cypherpunk

Someone advocating the widespread use of cryptography and other privacy-enhancing technologies as a route to social and political change.DAG (Directed Acyclic Graph)

A graph (a kind of data structure) that is directed and without cycles connecting the other edges.Dollar-Cost Averaging (DCA)

To systematically invest a fixed amount of money into an asset over a long period of time. This averages the cost of your investment, avoiding any sense of needing to "time the market". This is generally considered to be the safest, most level-headed way to invest.DAO (Decentralized Autonomous Organization)

An organization that executes rules through computer programs called smart contracts, where record keeping is done on the blockchain.Daniel Larimer

Creator of the cryptocurrency platform BitShares, co-founder of the blockchain social platform Steemit, and is CTO of EOS.Day Trader

A strategy of buying and selling assets within the same trading day, in order to turn a profit.DDoS (Distributed Denial of Service)

A common way to attack a network or website in order to render it unusable for a period of time. The attacker, often in control of a botnet, will overload the target by sending it more data than it can handle.Dead Cat Bounce

A small price recovery after a large crash, giving an indication of false hope for an ultimately dead asset. Comes from the phrase, "Even a dead cat bounces once."DPoS (Delegated Proof of Stake)

Invented by Daniel Larimer, it is an alternative consensus mechanism to Proof of Work. A cryptocurrency that uses DPoS votes for a "witnesses" to secure their computer network. Coin holders vote for "delegates", who are then responsible for validating transactions and maintaining the blockchain. It's used as a consensus mechanism in various cryptocurrencies such as BitShares, Lisk, EOS, Tezos, Ark, Nano and Cardano.Death Cross

A technical analysis indicator, where a short-term moving average crosses below a long-term moving average. This is considered to be a bearish signal.DeFi (Decentralized Finance)

Typically thought of in association with Ethereum, decentralized finance involves conventional financial tools built on a blockchain. This includes things like stablecoins, lending protocols, prediction markets, security tokens, derivatives and decentralized exchanges.Delisting

A delisting is when an exchange removes an asset from an exchange. This could be due to a variety of reasons, such as a change in legal regulations, or a team abandoning a project.Derivative

A contract that derives its value from the performance of an underlying entity (such as a digital asset or a stock).DEX (Decentralized Exchange)

An exchange that does not rely on a third party to hold the customer's funds. Trades occur directly on the blockchain using an automated process such as a series of smart contracts.Diamond Hands

A meme popularized during the rise in popularity of Gamestop (GME) on WallStreetBets. This is the opposite of "weak hands", people who sell their position (especially due to FUD).Difficulty

A measure of how much computational work must be performed by miners in order to find the next block.Distributed Ledger

A specific kind of database that is transparently shared and kept in sync across multiple redundant locations and parties.Divergence

When an asset’s market price is moving in the opposite direction of another technical indicator (such as RSI or trading volume). This is a strategy used by traders to detect a trend reversal.Dominance

This term refers to the percentage of the total crypto market cap that any specific cryptocurrency currently occupies. BTC Dominance, for example, is the BTC market cap divided by the total crypto market cap.Double Spending

Spending the same money more than once. This is a primary example of an issue that the blockchain solves (when working correctly). A 51% attack would allow the attackers to double spend their tokens.EEA (Enterprise Ethereum Alliance)

A group of companies allied with the goal of making Ethereum work for large scale business purposes.EIP-1559 (London Hard Fork)

A hard fork of the Ethereum protocol that introduced a change to slow down the issuance of new ETH, and make transaction fees more predictable. Moving forward, a fraction of all transaction fees in each block will now get burned (destroyed). If enough fees are paid in a given day, ETH actually becomes deflationary (the amount in circulation decreases).ENS (Ethereum Name Service)

A decentralized service which allows Ethereum addresses to be replaced with human-readable names.Equihash

An asymmetric memory-bound Proof of Work system that is based on the generalized birthday problem. Its memory intensive nature can be used to prevent ASIC mining. ZCash and its numerous forks are the most notable cryptocurrencies that use the Equihash algorithm. Developed by Alex Biryukov and Dmitry Khovratovich at the University of Luxembourg.ERC-721

A standard format for implementing non-fungible (unique) tokens on the Ethereum blockchain. A common example of non-fungible tokens are collectibles, such as CryptoKitties.ETF (Exchange Traded Fund)

A security that tracks another asset, such as a commodity, group of assets, or an index. It can be traded like a common stock on a stock exchange.EVM (Ethereum Virtual Machine)

The runtime environment for smart contracts in Ethereum. It is sandboxed and completely isolated from the network, filesystem or other processes of the host computer system. Every Ethereum node in the network runs an EVM implementation and executes the same instructions.Exposure

A trader is said to have exposure to a specific market when they will be monetarily affected by that market moving in price (either directly or indirectly through a derivative).Faucet

A free source of a cryptocurrency (typically a very small amount). It may be in exchange for completing a trivial task.Fibonacci Retracements

In technical analysis, it is often observed that when markets move substantially in one direction, they often pull back to specific levels before continuing a trend. These levels correspond with ratios derived from Fibonacci numbers (23.6%, 38.2%, 50%, 61.8% and 100%).Flash Loan

An uncollateralized loan that is both created and destroyed within a single transaction. Can be used by developers to exploit a system or capitalize on arbitrage opportunities.The Flippening

A meme referring to a day when the Ethereum market cap overtakes the Bitcoin market cap.Floor Price

The "floor price" is how much it costs to buy the cheapest NFT in a given collection. It's the cheapest available asking price for that NFT.FOMO (Fear of Missing Out)

An emotional reaction following a bull run, leaving prospective investors afraid they've missed out on an opportunity.FUD (Fear Uncertainty Doubt)

The primary reasons an asset falls in price or causes someone to panic sell.Full Node

A node which downloads a full copy of the blockchain and helps validate it, among other things (such as store a memory pool of pending transactions). Different blockchain implementations may have nodes serve different purposes. Someone who runs a node should not be confused with a miner.Fundamental Analysis (FA)

A methodology of analyzing a potential intrinsic value of an asset based on both qualitative and quantitative factors such as economic metrics, competition and their product.Funding Rates

Funding Rates are periodic payments made by those holding a position of a perpetual futures contract. When the funding rate is positive, the price of the perpetual contract is higher than the market price. Thus, traders who are long pay to those with short positions. Conversely, a negative funding rate means that short positions pay to those who are long. Crypto funding rates aim to prevent divergence in the price between the futures contract and the current market (or index) price. The rate is expressed as a percentage. Positive funding rates imply that more traders are currently long vs short, and vice versa. While this can be used to measure market sentiment, it will not necessarily predict price movements.Futures Contract

A derivative product representing a legal agreement to buy or sell an asset at a predetermined price at a specified time in the future.Gemini

Gemini is a cryptocurrency exchange founded in 2014 by the Winklevoss Twins. It has a strong focus on regulatory compliance (it is regulated by the New York State Department of Financial Services).Our platform offers free Gemini price alerts in addition to Gemini exchange listing alerts.

Golden Cross

A technical analysis indicator, where a short-term moving average crosses above a long-term moving average. This is considered to be a bullish signal.Governance

Governance refers to the method by which a cryptocurrency evolves over time. Certain coins have explicit "on-chain governance", which outlines a specific process by which proposed changes are voted on.GPU (Graphics Processing Unit)

A computer optimized for computing visual display information. It typically has a highly parallel architecture and excels at math-heavy calculations (and therefore, much better at mining cryptocurrencies than a regular CPU).Gwei

1 gwei = 0.000000001 ETH. Gwei is a common way of expressing Ethereum gas prices, which are used to calculate the cost of sending a transaction on the ETH blockchain.Hal Finney

The first person to receive a Bitcoin transaction from Satoshi Nakamoto. Many believe he is actually Satoshi himself.Hard Fork

A change in a blockchain protocol that is not backwards-compatible and requires all members involved to upgrade their software.HODL

A meme derived from the misspelling of the word "Hold". A mindset that encourages people to hold on to their cryptocurrencies and have faith in the longterm prospects of the industry. Often given the incorrect bacronym "Hold on for Dear Life".Hash Function

Any mathematical function that can be used to map data of arbitrary size to data of fixed size. In crypto, it is a one-way function that cannot be reverted. It's the kind of mathematical work used to mine cryptocurrencies.Hashgraph

A patented (closed source) "next-generation" consensus protocol that could theoretically render the blockchain obsolete. It features a "gossip protocol" where every node can spread signed information (events) on new and received transactions to randomly chosen neighbors. Neighbors will then aggregate received events with information from other nodes into a new event, and then send it on to other randomly chosen neighbors. This system can reportedly achieve an astonishing quarter-million transactions per second.Ichimoku Cloud

A technical analysis indicator which provides trading signals by identifying trend directions and momentum.IEO (Initial Exchange Offering)

A method of raising money by selling a newly created cryptocurrency directly on an exchange.Immutability

An object that cannot be changed once it is created, such as a transaction once it has been written to the blockchain.Impermanent Loss

When you provide liquidity to a market (likely a DEX) and the price of the token differs from when you first deposited them into the liquidity pool. Trading fees can help counteract this. Impermanent Loss happens when it would have been more profitable to just hold on to a given asset rather than provide liquidity in a pool.KYC (Know Your Customer)

A series of laws and regulations which require businesses to know the identity of their customers.Lazy Minting

Some NFT marketplaces allow a user to create an NFT without yet minting it to a blockchain. It only becomes "real" and actually minted once it is purchased. This allows the creator to not pay gas fees until the NFT has already been sold.Legacy Markets

This refers to traditional financial markets (stocks, bonds, ETFs, etc). Used to refer to the financial ecosystem that excludes cryptocurrencies.Lightning Network

A payment protocol that is built on top of a blockchain. It enables nearly instant transactions between parties and is one proposed solution to the scalability issues Bitcoin has faced.Limit Order

An order to buy or sell an asset at a specific price or better. A limit order is not guaranteed to execute.Liquidation

To convert assets into cash or cash equivalents by selling them on the open market. People and companies can be forced to liquidate assets when they are bankrupt.Liquidity

The availability of an asset to be bought and sold easily, without affecting its market price.MACD (Moving Average Convergence Divergence)

A technical analysis indicator which shows the relationship between two moving averages.MACD Crossover

A MACD Crossover is a trading indicator. It occurs when a short term moving average line intersects, or crosses over, the long term line. A crossover can occur in either a bullish or bearish direction.Margin Call

When the value of a brokerage account falls below a minimum amount, a margin call is the request for additional funds to meet that minimum requirement.Margin Trading

The act of using borrowed funds from a financial institution to trade in a leveraged manner.Market Depth

A way to represent the order book of a given market in real-time on an exchange. Strictly, it is the size of an order needed to move the market price by a given amount. This data is frequently visualized as a graph to easily digest.Market Order

An order that is executed immediately at the current market price. A market order is generally guaranteed to execute as long as there is any liquidity at all.Market Maker

An individual or company that quotes a buy and a sell price, hoping to make a profit on the bid–ask spread. Also known as a liquidity provider.Market Scanner

A market scanner is a system that collects market data and analyzes it for certain events or conditions. Traders can use market scanners to detect time-sensitive opportunities.Market Signals

Market signals are pieces of information that help inform a trader about the current sentiment of a market, and help provide context for potential future price movements.Masternode

A full node or wallet that keeps the complete copy of the blockchain, but also performs additional functionality that is specific to a given cryptocurrency (such as participating in governance, or facilitating instant transactions). Someone who runs a masternode typically needs to own a certain amount of tokens to qualify, and may in turn earn passive income from it.Max Supply

The maximum amount of coins or tokens that will ever exist in the lifetime of a given cryptocurrency.Mempool (Memory Pool)

The mempool is where pending Bitcoin transactions wait for their chance to be written to the blockchain. A mempool is hosted by a node. The order by which transactions are selected from the mempool is based on the transaction fee paid to the miners.Our platform supports free Bitcoin mempool size alerts to help monitor sudden changes in the network.

Merkle Tree

An important data structure commonly used within blockchains (as well as BitTorrent and Git). It allows for fast and secure verification of the contents of large data structures. Is used to test whether a transaction is included in a set or not.Metamask

A popular ETH wallet that can be downloaded as a chrome extension or a smartphone app. It has over 20 million users, and has introduced token swapping within the wallet itself.The Metaverse

A potential future version of the internet that uses AR and VR to create a persistent virtual environment. The term was coined in Neal Stephenson's novel, Snow Crash.MEV (Miner Extractable Value

MEV represents value that can be acquired from a block by re-ordering including, and excluding transactions. While transactions with the highest fees are typically always included in the next block, miners are not required to sort the transactions by highest paid fees. This allows them to reorder transactions to extract additional profits from users.Moving Average

A technical analysis indicator which takes the average of a specific number of previous data points in order to calculate its present value.Mining Algorithm

The nature of the computational work that must be performed by a miner in order to discover the next block on a blockchain. This is only applicable in Proof of Work style blockchains.Mining Pool

A group of miners who share their processing power over a network. Each member is rewarded based on the amount of work they contributed to the block they helped mine.Minting

Minting typically refers to the creation of an NFT. The person who mints an NFT is the first person to own it.Mixing

Also called "tumbling", it is the randomizing of pool of cryptocurrencies in order to obscure the original source of funds.Mt. Gox

A Bitcoin exchange based in Japan which got hacked and went bankrupt in February 2014. The original name is short for "Magic: The Gathering Online Exchange", which is what the site was originally intended for. It later became the first widely popular crypto exchange. It was founded by Jed McCaleb.Multisig (Multisignature) Wallet

A wallet that requires more than one key to authorize a transaction.Nash Equilibrium

A concept in game theory -- where a player receives no additional incentives to change their strategy if the strategies of others remain unchanged.NFT (Non-Fungible Token)

An NFT is a unique piece of data stored on a blockchain. It's a type of cryptographic token that can be bought, sold or transferred. It is often used to verify ownership of an item, such as artwork or any other digital good.Node

A computer connected to a given blockchain network. This is where transactions are initially broadcast, before they are written to the blockchain itself.Nonce

A "number only used once", which may have different meanings in contexts both in and outside of crypto. A cryptographic nonce is often used to ensure that old communications cannot be reused in replay attacks.Novi

Originally called Calibra, Novi is the name of Facebook's Libra wallet. Novi will be a standalone app that acts as a way to convert fiat money to the crypto assets that the wallet supports (and vice-versa). Initially, the wallet will support currency-backed stablecoins, such as LibraUSD, LibraEUR, LibraGBP and LibraSGD.Open-High-Low-Close (OHLC)

For any given period of time, the price of an asset is commonly expressed using these four metrics. The open is the price at the beginning of a given time window. The high is the max value within that window. The low is the minimum value, and the close is the value at the end of the window. This data is conveyed within each candle of a candlestick chart.Opensea

Opensea is one of the largest NFT marketplaces, where anyone can buy and sell NFTs by connecting a crypto wallet (no traditional account needs to be created).Optimistic Rollup

An (ethereum) scaling solution, where transactions are aggregated off-chain and a smaller receipt is submitted back to the chain periodically.Oracle

A service which allows for smart contracts to interact with data outside of the blockchain environment.Order Book

A current list of buy and sell orders for a specific asset on an exchange. Can be used to see if a market has sufficient liquidity to execute a trade at a given price.Orphaned Block

A valid block that is not part of the main chain. May occur when two miners produce a block at the same time, or caused by an attacker attempting to reverse transactions.OTC (Over the Counter)

An asset traded directly between two parties, and isn't tied to a formal exchange. An asset traded this way may not have the liquidity or transparency that an exchange offers.Overbought

A condition where an asset has recently increased in price to a point where there is an expectation of a short-term reversal.P2P (Peer to Peer)

A computer network which does not require a third party to operate. Instead, a user interacts directly with another user.Paper Bitcoin

This refers to a derivative of Bitcoin that represents the underlying asset -- but is not actually Bitcoin itself. For example, the Robinhood exchange does not allow you to withdraw BTC, because they only sell a Bitcoin derivative that is intended to reflect the price of the real thing.This may also refer to a Bitcoin Paper Wallet, which is an entirely different concept.

Paper Wallet

A physical document containing private keys or data which can generate private keys (such as a recovery seed). See: WalletPegged Asset

An asset who's price is designed to remain the same as another asset, such as a stablecoin.Perpetual Swap

A derivative product similar to a futures contract, but has no expiration date. BitMEX has popularized this kind of crypto derivative.PFP (Profile Picture

Many NFTs are used as profile pictures. These avatars are often NFT collections, which have a limited number of variants. Owners may do this to signal that they are part of a specific group, or to simply show off a valuable collectable.Pre-mine

Pre-mining is the creation of a certain number of tokens before the cryptocurrency is available to the public.Priced-In

When discussing a certain piece of information and how it relates to the price of an asset, it is said to be "priced in" when the current market price has already factored in this information.Prisoner's Dilemma

A common situation in game theory -- when individual players each acting in their best interest produce an undesired result that makes the whole group worse off.Private Key

A a string of letters and numbers that serves as a cryptographic key allowing a transaction to be sent over the blockchain. This is essentially your password for a wallet address, and should be held as securely as possible.PoI (Proof of Importance)

A blockchain consensus algorithm first introduced by NEM. Proof of Importance is the mechanism that is used to determine which nodes are eligible to add a block to the blockchain (this process is known as "harvesting" in NEM). It is different than Proof of Stake in that it factors one’s overall support of the network into account, not just the current moment in time. Vesting, transaction partners, number and size of transactions are all factors.Portfolio

A group of financial assets in someones possession. Each item in this group is known as a position.PoS (Proof of Stake)

The ability to mine cryptocurrency by simply holding coins in a wallet that is connected to the network. The more coins in the wallet, the more mining power.PoW (Proof of Work)

A piece of data that is computationally difficult to produce but easy for others to verify. It is the primary thing that miners do to discover new blocks and contribute to the integrity of the network.Public Key

The address used to send someone an amount of cryptocurrency. If a private key is your password, a public key is your username.Quadratic Voting

A specific voting process, and a proposed method of governing a blockchain. Voters are able to express how strongly they feel about an issue by purchasing more votes for a specific outcome. While voters can vote as many times as they want, the cost of each vote increases exponentially.Pump & Dump

A coordinated manipulation of the price of an asset. A whale or group of people all start buying a cryptocurrency causing the price to drastically increase very rapidly. This often causes wild speculation and others start buying it out of excitement. The original actors immediately sell everything they originally bought causing the price to come tumbling back down.Recovery Phrase

Also known as a mnemonic seed, it is a list of words which store all the information needed to recover a private key.Resistance Level

It is a price that a given asset typically has trouble reaching above. If it does reach above that level, it will likely climb even higher now that this level has been broken.Ring Signature

A technology used by Monero in order to obfuscate the input of a transaction. A message signed with a ring signature appears to be endorsed by any person within a certain group of people. It is computationally infeasible to determine which member of the group actually produced the signature.Ross Ulbricht

The creator of the Silk Road, currently serving a life sentence in jail. Known under the pseudonym "Dread Pirate Roberts".RSI (Relative Strength Index)

A technical analysis indicator used to identify overbought or oversold conditions when trading an asset.Rug Pull

A rug pull is usually when the creators of a project take all the money and run. Its when a project turns out to just be a scam.Safe Haven Asset

A financial asset that is expected to perform well (or at least retain its value) during an economic downturn. Gold is a common example, and many people think Bitcoin has the potential to display similar properties.satoshi (sats)

The smallest atomic unit that a Bitcoin can be divided into. 1 satoshi = 0.00000001 BTCSatoshi Nakamoto

The name of the anonymous creator (or creators) of Bitcoin and the author of the original Bitcoin whitepaper.Scamcoin

Also called a shitcoin, this refers to a token that provides little or no value, and is simply propped up on hype and false promises.Schelling Point

A concept or solution that people tend to choose by default in the absence of communication. The concept was introduced by Thomas Schelling in the book "The Strategy of Conflict". Has popular use in game theory.Scrypt

A hash function used by certain cryptocurrencies (notably Litecoin) as an alternative to SHA-256. It is more memory intensive, which means it is not well suited for ASIC hardware. This ensures that CPU and GPU remain viable methods to mine the coin.SEC (Securities and Exchange Commission)

A US federal government agency responsible for protecting investors by regulating securities markets. The mission statement of the SEC is to "promote a market environment that is worthy of the public's trust".STO (Security Token Offering)

Similar to an ICO, but the tokens issued offer more rights and may be backed by assets, profits, or revenue generated by companies. The idea is to give these tokens tangible value from day one, and reduce the component of hype and speculation.Segwit (Segregated Witness)

An upgrade to the Bitcoin protocol where signature data is removed from transactions, allowing more transactions to fit in a single block, increasing the speed of the network.Shill

Someone trying to spread hype about something by endorsing the product in public. Typically has negative associations.Sharding

A method of scaling a blockchain (increasing how many transactions can be processed per second) by splitting up which miners are working on what at a given time.Shielded Address

A kind of address used by ZCash that is highly private. They are not visible in the blockchain and offer strong privacy against transaction graph analysis. The value transferred is private if both the sender and receiver are shielded. Shielded addresses are not supported in every ZCash wallet.Short

A method of betting on an asset decreasing in value. When someone shorts an asset, the investor borrows that asset and immediately sell it, hoping to buy it back when it is cheaper.Short Squeeze

A rapid increase in the price of an asset due to a large number of short positions being liquidated at the same time.Sidechain

The ability to transfer assets from one blockchain to a separate blockchain and then be moved back if needed. It's a way for multiple cryptocurrencies to interact with one another.Signature

Information that allows someone to prove that they have a private key, without having to reveal the actual private key.Silk Road

An online black market, popularized as a platform for selling illegal drugs. It was only accessible via TOR, and only accepted Bitcoin as payment, which were tumbled in order to increase anonymity. Created by Ross Ulbricht.SIM Jacking

Also known as a SIM swap scam or SIM splitting, this is a method of hijacking someone else's phone number in order to gain access to other accounts tied to that person. The hacker does this by gaining basic information about the victim and then contacting their phone provider pretending to be them. It is advised to use an app such as Google Authenticator instead of a phone number for two-factor authentication (2FA).Slippage

Slippage occurs when there isn't enough liquidity in a given market to buy or sell an asset without affecting the market price. It's the difference between the expected price and the actual price when the trade executes. It's often expressed as a percentage.Smart Contract

A programmable way of executing logic on the blockchain. In addition to exchanging money, smart contracts allow arbitrary assets to be exchanged while avoiding a middleman.Stock to Flow Modal (S2F)

A theoretical model of Bitcoin's past and future price, primarily influenced by the amount of Bitcoin being mined at any given time. This means that the halving is the primary event that influences the price of Bitcoin, according to this model.Stable Coin

A cryptocurrency that is pegged to a specific value (usually a fiat currency) and is intended not to fluctuate in price.Staking

The process of holding funds in a cryptocurrency wallet to support the network of the blockchain that is tied to those funds. This is an alternative to traditional mining.Stealth Address

A way of sending cryptocurrency by giving additional privacy to the recipient. By using a stealth address, you ask payers to generate a unique address in such a way that you can deduce the corresponding private key. So although a single "stealth address" can be visible in public, the blockchain sees all incoming payments as going to separate addresses.Stop Limit

An order to buy or sell an asset that combines the features of a stop order and a limit order. Once a stop price is reached, a limit order is placed.Stop Loss (Stop Order)

An order designed to limit an investor's loss on a position. A trade that gets executed once a price reaches a certain level.Store of Value

An asset that can be reliably saved, retrieved, exchanged and predictably useful. Anything that retains these qualities as time passes is a good store of value.Swing Trader

A strategy of trading assets over a period of a few days to several weeks, in order to turn a profit.Swing Trader

A strategy of trading assets over a period of a few days to several weeks, in order to turn a profit.Tangle

A type of DAG (directed acyclic graph) used by IOTA. It's a network consisting of nodes that issue and validate transactions. A qualifying node must choose two other transactions to approve, ensure approved transactions are not conflicting, and solve a cryptographic puzzle. A "coordinator" is currently used as a centralized consensus mechanism to prevent attacks on the network, and is scheduled to be shut down once the network is stable enough.Technical Analysis (TA)

A methodology of valuing the price of an asset based on studying market data, such as patterns in price and volume.Testnet

An alternate blockchain meant for testing purposes. Coins on this chain have no value. See: Mainnet.Ticker Symbol

The abbreviation used to identify an asset on an exchange. They are typically 3 or 4 characters, and capitalized. For example, the ticker symbol for Bitcoin is BTC.Trading Bot

A computer program that automatically buys and sells assets based on the rules that it was programmed with. It can incorporate any number of strategies behind its logic, such as arbitrage, technical analysis or even social media sentiment analysis.Trading Indicator

Trading indicators are any metrics that are used to help inform someone of a potential trade.Trading Signal

Trading signals are automated notifications that suggest to a trader than it is a good time to buy or sell an asset.Total Supply

The amount of coins in existence. This number subtracts any coins that have been burned.TOR (The Onion Router)

Open-source software designed to protect a user from Internet surveillance by routing traffic across a randomized set of proxy servers.Trailing Stop Loss

A specific way of using a stop loss order. As the price of an asset rises, the stop price rises as well. But if the price falls, the stop loss price doesn't change. This is a way to limit losses while locking in gains.Transaction Fee

An expense that must be paid to miners in order for a cryptocurrency to be sent to a different wallet. This fee can vary based on how congested the network is, among other things.Transactions Per Second

The number of transactions that a given blockchain can handle/process each second. This is the primary metric used when thinking about scaling blockchains.Trend Line

A line that can be drawn (either horizontal or diagonal) in which the value of a given asset or indicator can frequently bump into but not cross. If a trend line is crossed, a larger price movement often follows.Trustless

A system that minimizes the amount of trust required from any single person or entity in a system by distributing it among many agents within it.Turing Complete

Turing completeness is a quality that a programming language possesses if it can be used to emulate a Turing Machine.Turing Machine

A Turing machine is a system that can simulate any computer algorithm, regardless of its complexity.Unconfirmed Transaction

A transaction that has not yet been included on a block, so it is still in a pending state.Unspent Transaction Output (UTXO)

UTXOs are a fundamental concept behind the way cryptocurrency is transferred on many blockchains, including Bitcoin. The total UTXOs tied to a given wallet address represents the amount of funds available in that wallet. Every transaction consumes elements from this set and creates new ones. When funds are sent to a wallet address, the remaining balance in that wallet is sent back to itself as an UTXO.User Activated Soft Fork (UASF)

A change in the blockchain protocol enacted by a majority of full nodes (as opposed to miners).Vanity Address

An address that you choose yourself, or at least partly. Different blockchains have different capabilities around this.Volume Spike

When trading volume dramatically increases in a short period of time. This often occurs in tandem with large price movements. A volume spike is often considered to add "conviction" to a price movement, and confirms a breakout from a trend line or pattern.WAGMI (We All Gonna Make it)

"Making It" means becoming wealthy. This is sometimes just abbreviated to GMI.Wallet

A wallet allows someone to store the private key for a given blockchain address. They come in many shapes and sizes, such as hardware, paper and brain wallets.Our Wallet Watch service offers free wallet monitoring for the Bitcoin and Ethereum blockchains.